Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Written by: Zac Robinson

Let’s face it, the traditional processes surrounding the processing and management of business-to-business accounts receivable are slow, inefficient and expensive. But both times and technology are changing, giving businesses an opportunity to revamp their processes to be more effective and efficient than ever before.

Let’s face it, the traditional processes surrounding the processing and management of business-to-business accounts receivable are slow, inefficient and expensive. But both times and technology are changing, giving businesses an opportunity to revamp their processes to be more effective and efficient than ever before.

With consumer reliance on mobile technology growing by the day, combined with increased mobile adoption by businesses, mobile is the next great wave of payment technology adoption for traditional business receivables. By 2016, business mobile usage is expected to be 13 times greater than it is today.

B2B payments technology is rapidly evolving and new game-changing payment solutions are being brought to market. This new technology offers your business—and your customers—with increased payment options and security, while also streamlining operations and automating time-consuming manual processes. Leveraging mobile payments capabilities can help optimize traditional accounts receivables processes and increase adoption among employees and customers alike.

A key consideration in mobile payments technology is its interoperability and integration with your existing systems and processes. After all, it will be important to look for a mobile payments solution that will readily integrate with your existing bank and processor relationships, as well as accounting software and other critical back-end systems in order to ensure an accelerated adoption process and provide a great customer experience. Mobile payment systems that leverage your current, unique business processes will help you increase efficiency and improve adoption without adding more complexity into your accounts receivable environment.

Streamlining the sending and receiving of invoices and/or remittance advices via mobile invoice presentment and payment will help your business reduce costs and improve payment timelines. What’s more, by moving from traditional paper-based paymets to mobile/electronic payments, you can also improve transparency, cash flow planning and reporting.

We’re all becoming more familiar (and more comfortable) with the use of mobile payment technology within our own consumer lives, but how can you begin to leverage this progressive technology to accelerate your payment processing and receivables management? We’ve put together a quick and easy list of five ways to begin leveraging mobile payments for your business.

The next frontier in remote deposit capture (RDC is mobile remote deposit capture (mRDC). mRDC adoption is projected to expand to 30 percent (48 million) of smartphone users by 2016. But increased adoption isn’t the only thing worth noting when it comes to mRDC, there is real cost savings to be realized as well—$3.88 per mobile check according to Mitek.

mRDC delivers businesses with the ability to significantly accelerate the acceptance of remittances—especially those collected in the field. No more taking down sensitive financial or personal information in an unsecure manner. No more waiting up to 30 or more days to receive a paper-based remittance and then several more days to process and post the payment (of course, this can vary across businesses and industries).

Upon accepting a paper check from a customer, a business representative simply uses a mRDC-enabled application to capture a picture of the check. Based on unique business rules, the image and associated ACH information is transmitted securely either to their chosen payment processing platform for review and payment, or in some cases directly to their banking institution. No data is stored on the phone and reps don’t have to worry about potentially transporting hundreds or thousands of dollars’ worth of payments with them through their day (see number four below for more on the security concerns in this area).

The benefits of mRDC don’t end with the business—for one, customers benefit significantly from increased payment security. For example, customers have the option to keep the scanned paper check for their files, or dispose of the paper copy in accordance with their compliance guidelines. mRDC makes use of both OCR (Optical character recognition) and duplicate MICR (Magnetic Ink Character Recognition) code technologies to ensure that once the check has been scanned and sent to the payment system or banking institution, potential fraudsters will not be able to attempt to deposit or cash the previously scanned paper check.

Despite some of the extreme predictions that have circulated within the marketplace, checks are not dying. They will continue to be a preferred method of payment for consumers and businesses for many years to come. But what is changing is the way in which they can be accepted and ultimately processed. And mRDC is poised to open up many new possibilities both for consumers and businesses.

Traditional receivables processes start and end with the invoice and remittance advice. In the past (and even yet today), businesses would issue an invoice and then wait to receive payment via a paper check. This was not only time consuming, but also expensive due to the costs associated with printing and mailing the invoice.

Increasingly, businesses are realizing not only significant cost savings, but increased customer satisfaction from the ability to move away from paper-based invoices and not only deliver electronic invoices, but also provide their customers with 24×7 web payment portals where they can accept ACH, credit and debit card payments.

But customers are no-longer just digital, they are mobile. This goes for end-consumers and businesses. They not only demand the ability to view their account information anywhere and at any time, but they expect to have nearly the same capabilities whether they are sitting at their PC or on their mobile phone.

As the app revolution continues to innovate the ways businesses operate, we’re seeing the demand to further extend electronic bill presentment and payment (EBPP) functionality to the mobile channel. By making invoice information and payment channels available via the mobile channel, companies are giving their customers—whether B2B or B2C—yet another readily accessible channel to review outstanding invoices and provide remittance. All while saving cost over traditional paper-based invoices, enhancing the customer experience and accelerating the overall receivables process.

While cash remains the universally accepted method of payment—especially for B2C businesses—B2B organizations have undergone a major shift in the number of payment methods they accept and prefer. But in any business, the customer drives the demand, and B2B customers are demanding more ways to pay.

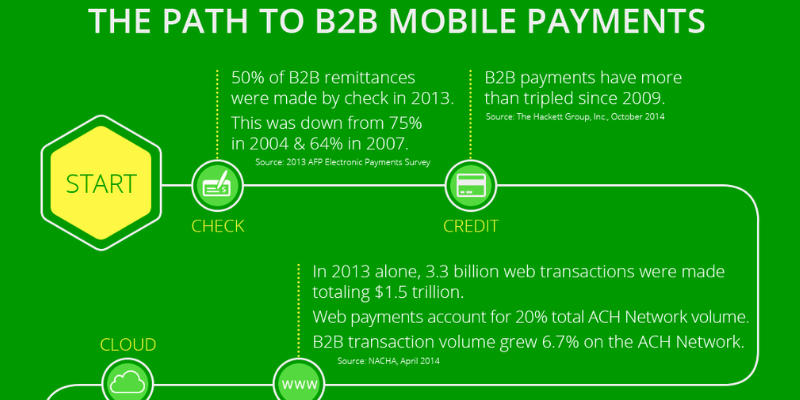

In the past, checks were the preferred—and many times only—payment method offered to B2B customers. Today, checks continue to play a large role in B2B payments, but technologies such as RDC and mRDC are changing how businesses accept and process these payments. Credit and debit card payments have increased in acceptance and in some cases are even passing checks as a preferred payment method.

But regardless of what payment methods a business chooses to accept, one thing is clear—customers expect to have access to those payment methods across any payment channel. Integrating core payment channels such as ACH, check (via mRDC), and credit/debit card into not only your web payment portal, but also your mobile application, can provide significant competitive differentiation and a stickier customer experience.

For quite some time, due to the paper-based remittance of most B2B payments (via check) there was a perceived level of increased security. After all, no sensitive financial data was being beamed over the internet for hackers to intercept. No worries, right? Wrong.

Checks were reported as the leading form of payment targeted for fraud in the 2014 AFP Payments Fraud and Control Survey, with 82 percent of respondents citing fraud attempts on check payments at their company. The survey also indicated that MICR line alteration counterfeiting was the most prevalent fraud method for checks.

But let’s not forget the most basic form of transaction security there is—limiting the human handling of payments whenever possible. As trust-worthy as employees may be, humans-will-be-humans and unfortunate events will happen from time-to-time. For companies that accept payments in the field, improving security can also mean not putting your employees in situations where they could be potentially transporting hundreds and even thousands of dollars in check payments during their day, making them a potential target of criminals.

Deploying mobile payments can eliminate traditional paper-based payment security concerns and even take it a step further. By enabling your customers to pay (and your reps to accept) via a fully-hosted mobile payment application or embedded payments component within your existing mobile app, you can gain the ability to accept multiple payment methods—ACH, check (via mRDC), credit and debit card—securely.

Be sure to look for a provider that leverages the end-to-end encryption of payment and personal identification data. This ensures payment information is transmitted securely from the device to your provider’s payment servers without any data ever being stored on the phone. What’s more, reps don’t have to worry about carrying around potentially large sums of money in the form of checks or transporting sensitive personal and account information associated with customers’ credit cards.

As businesses continue to evolve their business models and processes to better leverage the Web and mobile apps, integration with new and existing platforms, processes and business rules become integral. Ensuring these new channels offer optimal integration with existing business platforms and processes can create new operational efficiencies and deliver an enhanced, competitively differentiated customer experience.

When your business looks to begin leveraging mobile payments within your receivables processes, seamless integration with existing banks, credit card processors, accounting software and other back office systems will be key. Selecting a provider and platform that allows you to leverage your existing, unique business processes and rules will increase efficiencies and improve adoption for your employees supporting mobile payments and your customers using the application.

At a certain point, each new platform or solution can’t simply be additive, there comes a time when some consolidation of legacy technologies must take place. Payments is one of those areas where companies may very well benefit from some consolidation. A recent study found that 56% of organizations use soiled electronic bill presentment and payment systems which cost those organizations more than $1 billion each year collectively.

As your business evaluates adding mobile payments to your receivables processes, be sure to look for a partner with a proven platform that can help you work toward the strategic goal of simplifying your receivables to process and post from a single platform. Putting in the time up front to find a solution and partner that provides the optimal balance of integration capabilities and functionality to support the consolidation of legacy payment technologies will go a long way towards achieving the goal of truly integrated receivables processing.

Originally published December 17, 2014.

Sources: Cisco VNI, May 2012

Whether you’re one of the world’s largest corporations, a small Internet store or somewhere in...

Read More

Today’s growing portfolio of payment channels continues to add new levels of complexity to payment...

Read More

There’s never been a better time to start taking advantage of the new technologies that are...

Read MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864