Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Written by: Kurt Matis

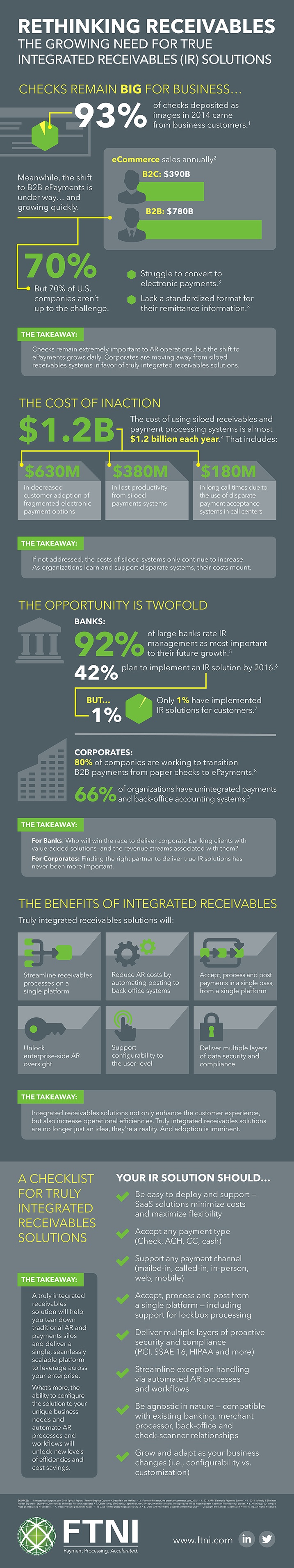

Believe it or not, people (and companies) are still using checks to pay their bills. In fact, in 2014, 93 percent of checks deposited as images came from business customers.¹

The time-tested routine of invoice and check within traditional accounts receivables (AR) processes has officially been disrupted as the world races towards electronic payments. Disrupted, yes. Dying, perhaps. But not dead.The ability to efficiently and cost-effectively manage check payments is still—and will continue to be—the foundation of a successful AR organization.

So if you’ve found yourself lured by the siren song of “checks are dead,” you may be feeling a little jaded these days. As businesses have been pressed by customers to support a growing number of payment types (Check, ACH, Credit Card, Debit Card, Cash, etc.) and payment channels (mailed-in, called-in, in-person, online, mobile), they’ve been forced to adopt multiple payments solutions and platforms to keep up with customer demands.

So if you’ve found yourself lured by the siren song of “checks are dead,” you may be feeling a little jaded these days. As businesses have been pressed by customers to support a growing number of payment types (Check, ACH, Credit Card, Debit Card, Cash, etc.) and payment channels (mailed-in, called-in, in-person, online, mobile), they’ve been forced to adopt multiple payments solutions and platforms to keep up with customer demands.

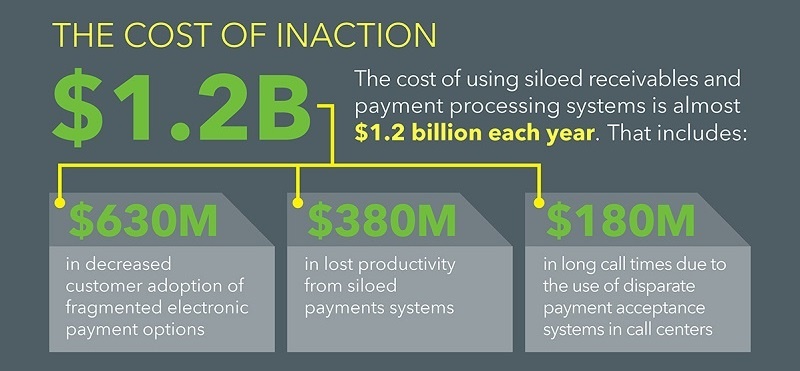

What you’ve likely been left with is a maze of disparate systems and legacy software that is causing increased complexity, minimal or no integration between platforms, a lack of consolidated reporting, extensive reconciliation points, and ever-increasing costs for maintenance, training and support. And the problem isn’t going to get any better if left alone—the estimated cost of U.S. companies using siloed receivables and payment processing systems exceeds $1B each year.²

As companies work to transition payments from paper checks to electronic payments, a major challenge remains as two out of three companies acknowledge a lack of integration between electronic payments and back-office accounting systems.³ What benefit is accepting electronic payments if you still have to manually post those payments to your back-office systems? What could be streamlined, still remains siloed for many organizations.

Truly integrated receivables solutions help corporates and banking institutions alike eliminate siloed receivables systems and platforms by accepting any payment type, from any payment channel and automatically posting remittance information into back-office systems (i.e. straight through processing). All on a single, secure, fully-compliant, cloud-based receivables hub. Unlike a dashboard that just brings together transactions from disparate systems, truly integrated solutions support the initiation, acceptance, processing and posting of all transactions from a single, unified platform.

Perhaps the biggest shift in the last 6 months has come in the form of banking institutions elevating their focus and demand for truly integrated receivables solutions and actively pursuing partnerships to enable them to implement integrated receivables solutions with their corporate clients.

This evolution will further enhance the bank’s relationship with the corporate client by not only offering traditional banking services, but also value added software that leads to true operational savings. In essence, the bank becomes a more valuable partner in the success of the business.

However, Only 1 percent of banks have implemented integrated receivables solutions, even though 92 percent of large banks rate receivables management as most important to their future growth.4, 5 That’s a pretty big opportunity to let pass you by. And word has spread: recent studies indicate that almost half of banks in the U.S. plan to implement an integrated receivables solution in 2016.6 For banks, the time to strike is now.

When it’s done right, Integrated Receivables solutions enable a bank’s corporate clients to add new payment channels quickly and cost-effectively, without extensive training or IT work. Lockboxes can run on the same platform too—further unifying some of the traditional receivables offerings banks have offered their corporate clients.

Whether taking the road of third-party technology partner, bank or credit union, the destination is still a truly integrated receivables solution that is easily configurable and automates back-office posting processes.

Realizing the many benefits of an integrated AR solution can transform your business, maximizing operational efficiency and security. Through AR integration, your company will gain a competitive advantage through a variety of system enhancements.

Checks Remain BIG for Business

Checks remain extremely important to AR operations, but the shift to ePayments grows daily. Corporates are moving away from siloed receivables systems in favor of unified receivables solutions.

The Cost of Inaction is High

If not addressed, the costs of siloed systems only continue to increase. As organizations learn and support, and maintain disparate systems, their costs mount.

The Opportunity is Twofold

For Banks: Who will win the race to deliver corporate banking clients with value-added solutions—and the revenue streams associated with them?

For Corporates: Finding the right partner to deliver true IR solutions has never been more important.

The Benefits are Many

Integrated receivables solutions not only enhance the customer experience, but also increase operational efficiencies. Truly integrated receivables solutions are no longer just an idea, they’re a reality. And adoption is imminent.

Bring Down the Silos

A truly integrated receivables solution will help you tear down traditional AR and payments silos and deliver a single, seamlessly scalable platform to leverage across your enterprise.

What’s more, the ability to configure the solution to your unique business needs and automate AR processes and workflows will unlock new levels of efficiencies and cost savings.

The key is to find a unified solution, one that eliminates the need to have multiple payments solutions and platforms. Imagine being able to accept any payment type, from any payment channel, and being able to automatically post remittance information into your back-office systems. We call that straight through processing, and the technology is available today.

Imagine the costs you could save by automating your AR processes and workflows with a truly integrated system: instead of having talented employees work on rote tasks, they could be working on solving complex problems, or developing new business strategies from the insights you can gain from your system’s automated collection of data.

The future of AR is here: integrated receivables solutions delivered from a single platform. Our newest infographic dives deeper into the growing need for these enhanced receivables solutions and the trends driving both corporates and banking institutions to leverage and provide these services and solutions.

Sources: 1 – Remotedepositcapture.com 2014 Special Report: “Remote Deposit Capture: A Decade in the Making” | 2 – ACI Worldwide & Wiese Research Associates study, “Identify & Eliminate Hidden Expenses,” 2014 | 3 – 2013 AFP “Electronic Payments Survey” | 4 – Treasury Strategies, Inc. | 5 – Celent survey of US Banks, 2014 | 6 – Aite Group, 2014 Impact Note on Integrated Receivables

Originally Published December 17, 2015.

FTNI’s cloud-based Receivables Processing Platform allows easy setup, deployment & support OMAHA,...

Read More

Invoice presentment, also called e-invoicing or electronic billing, is essentially sending invoices...

Read More

Originally published on pymnts.com on 2/22/17. Horicon Bank and Financial Transmission Network,...

Read MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864