Advanced Remote Deposit Capture

Boost Your Check and Remittance Processing, Deposit and Cash Application Operations with Enhanced RDC Features—All on a Single, Cloud-based Platform.

Contact Sales (402) 933-4864

Boost Your Check and Remittance Processing, Deposit and Cash Application Operations with Enhanced RDC Features—All on a Single, Cloud-based Platform.

While the future of payment acceptance and processing is undoubtedly trending towards electronic payment methods and channels, check processing is, and will continue to be, the foundation for successful accounts receivable (A/R) operations. Regardless of the increased use of online, digital and mobile payment channels used by large and small businesses, consumers and banks alike—the oversight, management, deposit and posting of paper checks is key to organizations' receivable operations.

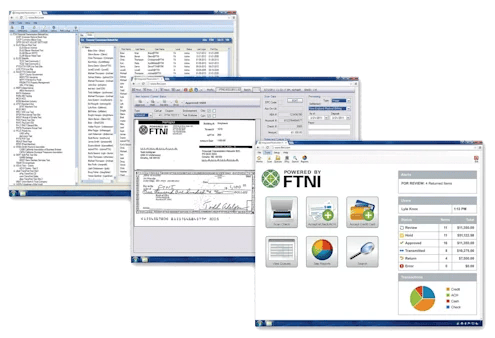

As one of the first integrated receivables solution providers in the market, FTNI recognized the need and value early on for the use of remote deposit capture (RDC) and mobile remote deposit capture (mRDC) within businesses' A/R operations. Designed as a flexible check processing solution delivered in an SaaS model, ETran’s enhanced RDC and mRDC capabilities can be seamlessly integrated with your existing back-office systems, banking institution(s) and virtually any scanner or mobile device based on your scanning needs.

Accelerate and automate your check-based A/R requirements with seamlessly integrated, flexible RDC and mRDC solutions that can centralize not only your check processing operations, but also, any payment method (debit/credit card, check, cash, and ACH transactions)—all from a single, cloud-based platform.

Many companies struggle with inefficient, expensive—and many times disparate—receivable systems and processes. Core to those A/R processes is check processing and cash application.

ETran's advanced RDC module delivers the ability to scan checks and remittance advices while seamlessly viewing, associating and storing all account and payment information in a highly-secure (and compliant), central location. The ETran RDC system conveniently supports centralized and distributed check processing environments (including mRDC) via a single, easy-to-use interface. And, it enables efficient integration with any market accounting system(s), bank, check scanner or mobile device.

ETran Mobile is seamlessly integrated with FTNI's integrated receivables RDC module and offers the ability to accept checks, as well as credit/debit cards and ACH, via a user-friendly, secure mobile application. All payment methods and history are securely stored for an all-access view into customer information, and payments accepted via the application are available in real-time for review/approval within the ETran desktop application.

No more tedious trips to the bank for manual check deposits. No more sending and receiving paper checks in the mail from your customers. And, no more manual data entry and accounts receivable tasks for your internal team. Discover truly integrated receivables mobile remote deposit capture solutions to streamline and accelerate your A/R operations. For additional information, download our Mobile Payments eBook today.

Easily and affordably deployed, implemented, configured and supported desktop and mobile RDC solutions to help you accelerate check and remittance acceptance, processing and posting.

ETran’s enhanced desktop solutions come with the added benefit of being seamlessly integrated with ETran's mobile check processing capabilities, helping you unlock the power of mobile check acceptance on a single platform.

ETran’s Mobile RDC (mRDC) capabilities enable your business to securely accept check payments in the field either via a fully-hosted, stand-alone app (iOS and Android), or by integrating our mobile remote deposit capture APIs into your own Android or iOS mobile application.

ETran's RDC solutions feature Intelligent Invoice Matching and Electronic Invoice Presentment and Payment (EIPP) capabilities to match check payments to outstanding customer invoices and automate cash application operations.

Capable of receiving open invoice and customer information via batch file or real-time API calls, ETran is able to automatically match incoming check payments to customer invoices, as well as customer account information, reducing the time your A/R team spends on matching data and applying cash into back-office systems.

Whether you're a bank/financial institution providing outsourced lockbox services for your corporate clients, a BPO service provider delivering lockbox managed services, or a business running your own internal lockbox operations, maximizing efficiencies and oversight within high-volume check processing operations translates into cost savings, improved business intelligence and when done right, a clear path to automated cash application.

FTNI's Remote Deposit Capture solution is a fully-integrated system that can be used as the engine of internal lockbox operations. For example, ETran is currently used to drive lockbox operations at firms managing as little as a few thousand checks per month to powering lockbox operations taking nearly 1 million checks and associated original items monthly. ETran can also be used to bridge the gap between your outsourced lockbox service provider's (bank's) feed and your systems.

ETran is agnostic by design, delivering you with the flexibility to utilize your existing check scanning hardware, bank/financial institution and back-office system(s).

Conveniently capture check payments through any check scanning hardware or mobile device (iOS or Android), transmit the transactions to one or multiple bank settlement accounts for deposit based on business rules, and post remittance details to any back-office system in either batch or real-time to achieve true straight through processing.

ETran's Advanced RDC solutions feature magnetic ink character recognition (MICR) matching and optical character recognition (OCR) technology to automatically match MICR line data, account information and dollar amount data on checks to customer accounts.

By automatically matching incoming checks and remittance documents scanned into the ETran software to customer accounts, traditionally manual, time-consuming A/R tasks supporting data entry and cash application can be streamlined—allowing new workflow automations to free up time that can be spent on higher value functions in your internal operations.

Conveniently deploy and support centralized or distributed check processing environments via a single, cloud-based user interface. Streamline and automate business processes, workflows, and exception management surrounding check payments to increase efficiencies and save cost.

ETran is configurable down to the user-level across multiple brands, LOBs, locations, customers and more. You also have the ability to configure customer data by up to 20 configurable elements for automated posting processes, as well as the ability to configure reports based on your A/R needs including: payment date, deposits, running transaction log, and other general client and transactional information.

ETran's desktop and mobile RDC capabilities continue our strategic mission of delivering truly integrated receivables solutions that seamlessly integrate with any back-office system in either batch or real-time to streamline and automate the cash application process.

By building and keeping trusted partnerships with your technology/service provider—that provides automated posting services—you are able to speed your business' collection rates and A/R requirements, all from a single, cloud-based RDC system.

With ETran's cloud-based architecture, you get the unique benefits of multiple layers of compliance and proactive security.

First, you'll gain PCI and HIPAA compliance directly at the ETran site layer. Second, you'll benefit from industry-leading security requirements (PCI, HITRUST/HIPPA, SSAE16 and more). For more information, visit our service provider, Armor.

RDC Systems & Services

Efficiently and affordably deployed RDC solutions to help you accelerate the acceptance, management, deposit and posting of check payments across your A/R organization.

Mobile Check Capture

Securely accept checks, as well as ACH and credit/debit cards, in the field with the ETran Mobile application—all with seamless integration into the ETran user interface at your home-office.

Flexible Lockbox Solutions

Lockbox solutions that provide the flexibility to streamline the acceptance and deposit of all lockbox remittance items, regardless of in-house or outsourced services from your bank.

Automate Cash Application

Seamless, flexible integration with any accounting/ERP/CRM systems, in either batch or real-time, to automate cash application and reconciliation operations.

“We needed the ability to not only process check-based donation payments faster, but also ensure that we are able to efficiently and accurately update our back-office systems so that we can maximize donor engagement and appreciation. ETran’s advanced RDC and back-office posting solutions have helped us to do just that.”

Philly House

In this free eBook, learn five ways to improve your business with RDC and mRDC, including the key elements to look for in an RDC solution.

Easily support centralized or distributed check processing environments via a bank agnostic, easy-to-use, cloud-based platform.

This free eBook delivers a handy checklist for identifying and selecting a truly integrated receivables solution to meet your business needs.

Remote Deposit Capture (RDC) technology delivers companies’ accounts receivable (A/R) teams with the ability to scan paper checks and remittance advices while seamlessly viewing, associating and storing all customer account data and payment information in a highly-secure (and compliant), central location. RDC solutions provide a streamlined check processing solution to automatically match incoming check payments to customer accounts, deposit payments to associated settlement accounts, and post all remittance details to any back-office system in order to accelerate receivable processing and cash application operations.

No, RDC technology is not high risk, as long as you are partnering with a technology provider that provides complete security and compliance across the receivable solution.

By choosing an integrated receivables provider that delivers Advanced RDC solutions, you are able to set up check processing technology that fits your business’ unique A/R needs.

Set up and implementation of RDC requires business workflow information, as well as your settlement account details and banking institution relationship. However, the heavy lifting of set up is done by your chosen technology provider—all technical details are handled by your provider and further training will be instituted to provide your A/R team with the necessary skills to manage your RDC solution after implementation.

Remote Deposit Capture provides an in-house desktop check processing solution while mobile deposit helps your field team and sales representatives to capture check payments on the spot through their mobile device.

Typically, banks will charge for remote deposits if you are utilizing a check processing/depositing solution through your bank. However, bank-provided solutions lack the ability to post the captured remittance detail back to your back-office system(s). With third party RDC solutions, you are able to accept, process and post all check payments in a single pass.

Check with your financial institution for best practice. A remote deposit capture (RDC) system on a truly integrated receivables platform can store the image and data associated with the check electronically for easy retrieval and review.

Work with your bank to determine the best practices after electronically depositing checks. Each business and bank are unique in their own processes and requirements.

No, someone cannot send you a picture of a check. For desktop check scanning functionality, you will need to have a physical check to scan into the system. Once uploaded into the ETran system, you are able to process and manage the check payment electronically. You are also able to utilize mobile RDC (mRDC) technology to accept check payments. With mobile payment solutions, you are able to capture a picture of the front and back of a check, associate the check payment to open invoices and customer account details, and send the payment to the home office for review, deposit and posting.

Yes, with Advanced RDC solutions you are able to scan a check through your existing check scanner and the payment will be automatically deposited at the end of the day.

The Check Clearing for the 21st Century Act (Check 21) is the federal law that took effect in October of 2004. The Check 21 Act gives banks and other financial organizations the ability to create electronic images of consumers’ and businesses’ checks in a process known as check truncation. Following this act, FTNI recognized the need for advanced check processing solutions across the B2B payments landscape. This led to the creation of ETran, a platform to help A/R organizations streamline their check processing operations.

The cost of Remote Deposit Capture services is dependent upon a few factors in your business: transaction volume, all modules utilized from your technology provider, and a few other varying factors. Since the ETran platform is modular by design, pricing really depends upon your usage of the platform and your business’ unique needs.

Unlike traditional check deposit services from most banks and financial institutions, enhanced remote deposit capture options process payments and deposit checks from business customers in a timely manner with the added benefit of automatically clearing the remittance detail to post into your back-end system(s).

Check handling associated with bank operations typically lacks the basic requirements and additional functionality to handle large volumes of paper checks while simultaneously applying and posting all payment data. With Advanced RDC technology, checks are processed electronically from a single interface with the ability to make multiple deposits to different settlement accounts.

Financial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864