AutoPay Solutions

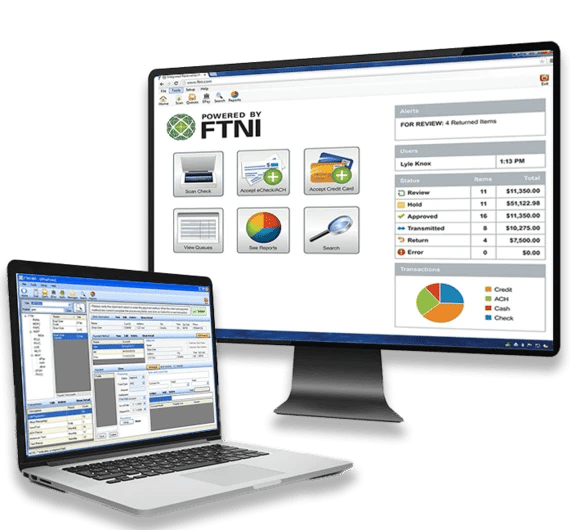

Easily Accept and Manage Single or Recurring ACH and Credit Card Payments from a Single User-Interface.

Contact Sales (402) 933-4864

Easily Accept and Manage Single or Recurring ACH and Credit Card Payments from a Single User-Interface.

The landscape of electronic payment options continues to evolve at an ever-increasing pace. Today's customers (B2C and B2B alike) are increasingly seeing new convenient and contactless payment options enter the payments landscape. The unfortunate truth is that many businesses still have outdated and inefficient methods and systems for accepting, processing and posting electronic payments from their customers.

FTNI's ETran Autopay solutions facilitate automatic ACH and credit/debit card payments based on customers' unique payment terms and open invoices. AutoPay delivers configurable, automated payment parameters on a customer-by-customer basis, as well as the ability to send proactive payment reminders detailing the invoices to be paid and upcoming payment draft dates.

AutoPay seamlessly integrates with FTNI's integrated receivables platform, ETran, to provide complete oversight of all payment activity across your A/R organization. Users can access all incoming data through ETran's unique configurable ledger columns, with the added benefit of convenient, secure access to payment data for posting to your back-office system(s).

ETran's AutoPay solutions automate the traditionally manual and time-consuming processes surrounding the initiation, invoice matching, and cash application of one-time or recurring payments.

Especially powerful for industries where recurring payments are the same each month, but perhaps even more valuable for businesses where invoice amounts continuously change, AutoPay enables users to configure payment rules and timeframes within clicks.

Highly-configurable based upon unique payment parameters, customers are able to set up payment initiation/automatic withdrawals on a weekly, monthly, quarterly, etc. basis. Additionally, users enjoy the ability to customize the timing of notification emails prior to payments being drafted. These reminder emails can include information such as the number of invoices to be paid, invoice dates and payment amount.

Powerful, automated payment initiation, acceptance, processing and posting from a single, truly integrated receivables platform.

Automated initiation, processing and posting of invoice-driven varied amounts or static amounts. Configurable on a customer-by-customer basis, ETran AutoPay facilitates automatic recurring ACH/EFT and/or credit/debit card payments based on unique payment terms and open invoices.

Deliver your customers with personalized email notification reminders for upcoming payments to be processed. Email notifications are white labeled with your branding.

Recurring payments can be setup to pay open invoices on a daily, weekly, monthly, or bimonthly basis. Users can further tailor payment timing by selecting a specific day of the week for payments to be initiated. In the event that multiple invoices need to be paid outside of a customer's normal recurring payment schedule, business rules can also be configured to initiate payment(s) for invoices with due dates within a specific time period.

As is consistent with all modules on the ETran platform, ETran's AutoPay solutions maximize flexibility and scalability within your A/R operations by working with your existing bank(s), merchant processor, and back-office systems.

Having an agnostic system means you don’t have to change platforms or rebuild existing processes as your business, financial or back-office technology needs change today, tomorrow and years into the future.

Achieve true straight through processing of your AutoPay remittances thanks to ETran's ability to seamlessly integrate with any back-office system in either batch or real-time to streamline and automate cash application.

Single and recurring automatic debits to accelerate payment acceptance, posting and management.

Automated convenience for users to easily and securely set up on-time payments based on unique parameters.

Electronic invoice presentment and payment (EIPP) features and functionality to streamline invoice payment.

Proactive notifications, email reminders and payment receipts for a better customer payment experience.

.png?width=400&name=HardecsQuote_Image%20(1).png)

“Our controller told me we simply didn’t have the staff to handle more ACH payments—and then, we discovered FTNI. Their solution integrated seamlessly with our back-office system and transformed our payment processes. Today, over 95% of our customers are enrolled in AutoPay, and we’ve achieved that with less cost than adding even one new accounting staff member. It’s been a game-changer for our efficiency and accuracy.”

Hardec's Wholesale Distributors

ETran’s AutoPay features facilitate automatic ACH and credit/debit card payments based on customers’ unique payment terms and open invoices.

Learn how integrated receivables processing and management reduces costs and enhances customer service.

Your customers’ payment preferences are quickly evolving, but are your payment systems and processes ready to keep pace?

Whether you’re utilizing AutoPay or an online payment solution, your organization is able to provide customers with the ability to set up recurring ACH and credit/debit card payments. With standard or custom AutoPay features, internal A/R users are able to set up business customers with automatic debit based on unique payment parameters. With online payment capabilities, customers are able to log in to a payment portal and select the ability to have invoice payments recur automatically.

AutoPay delivers your customers with a better, more simplified payment experience while providing A/R teams with complete oversight of all incoming payments and automated payment/invoice matching to customer accounts for cash application. AutoPay streamlines collection efforts and provides customers with proactive reminders and email receipts.

An ACH (Automated Clearing House) payment is a type of electronic payment method that transfers money between bank accounts. This type of bank-to-bank payment transfers funds to/from bank accounts rather than going through card networks or depositing paper checks.

The safest online payment method is commonly regarded as credit cards due to their online security features and fraud monitoring.

The types of digital payments that are used across B2B receivables are ACH/EFT, credit card and debit card.

If your customers are making recurring payments on a regular basis, of similar or differing amounts, automatic payments could be a good way to streamline your payment acceptance, processing and posting across your receivables.

An automatic debit means that an individual or customer gives an organization permission to automatically take payments from their bank account on a recurring basis.

Automatic payments are payments that are scheduled to be automatically charged to a customer’s credit card or withdrawn from their bank account.

Yes, automatic payments are safe. By working with a technology provider that has complete security and compliance across their platform, you are able to securely and efficiently make and manage payments.

No, money cannot be taken from an account without permission. You have to authorize/agree to money being automatically withdrawn from your banking account.

Financial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864