Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

If there is one thing distributors are familiar with, it's complexity.

In the case of accounts receivables (A/R) processing and management, much of the historical complexity surrounding these operations has resulted from paper-based remittances (i.e., checks) and the lack of available technology solutions to help address the manual, time-consuming and error-prone processes many distributors experience within their A/R departments.

As companies work to transition customer remittances from paper checks to electronic payments, two out of three acknowledge a lack of integration between electronic payment solutions and back-office systems. What benefit is accepting electronic payments if your team(s) still have to manually post those items to your back-office systems? What’s more, as recent as two years ago, 93 percent of checks deposited as images came from business customers. Efficiently and cost-effectively managing check payments is still—and will continue to be—the foundation of successful A/R operations even as the adoption of electronic payments continues to rise.

Discover how Shamrock Foods Company, the seventh largest foodservice distributor in the U.S., has been able to expand and seamlessly scale its accounts receivables operations on a single, Software-as-a-Service (SaaS), integrated receivables platform to decrease DSO, increase cash flow, and take control of its A/R operations like never before.

In this episode of FTNI's True Integrated Receivables Spotlight Series, Patty King, Director of Credit, Shamrock Foods Company, joins Zac Robinson, Senior Vice President of Sales & Marketing, FTNI, to discuss how Shamrock Foods has been able to transform its A/R and cash application operations on a single, truly integrated receivables platform to achieve game-changing results.

If there is one thing distributors are familiar with, it's complexity.

In the case of accounts receivables (A/R) processing and management, much of the historical complexity surrounding these operations has resulted from paper-based remittances (i.e., checks) and the lack of available technology solutions to help address the manual, time-consuming and error-prone processes many distributors experience within their A/R departments.

As companies work to transition customer remittances from paper checks to electronic payments, two out of three acknowledge a lack of integration between electronic payment solutions and back-office systems. What benefit is accepting electronic payments if your team(s) still have to manually post those items to your back-office systems? What’s more, as recent as two years ago, 93 percent of checks deposited as images came from business customers. Efficiently and cost-effectively managing check payments is still—and will continue to be—the foundation of successful A/R operations even as the adoption of electronic payments continues to rise.

Discover how Shamrock Foods Company, the seventh largest foodservice distributor in the U.S., has been able to expand and seamlessly scale its accounts receivables operations on a single, Software-as-a-Service (SaaS), integrated receivables platform to decrease DSO, increase cash flow, and take control of its A/R operations like never before.

In this episode of FTNI's True Integrated Receivables Spotlight Series, Patty King, Director of Credit, Shamrock Foods Company, joins Zac Robinson, Senior Vice President of Sales & Marketing, FTNI, to discuss how Shamrock Foods has been able to transform its A/R and cash application operations on a single, truly integrated receivables platform to achieve game-changing results.

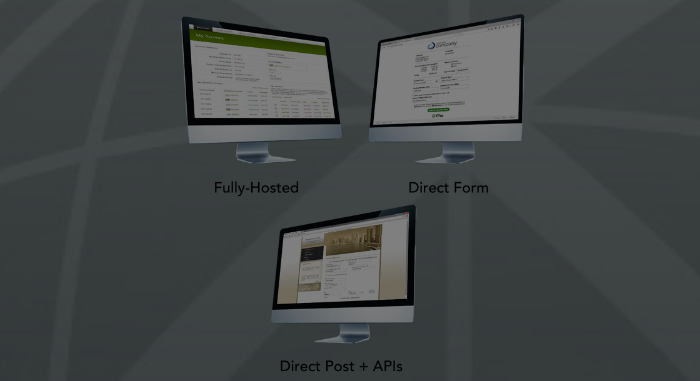

FTNI's ETran Online Payments solutions deliver multiple ways to conveniently and securely accept one-time or recurring online ACH and credit/debit card payments. Offering your customers a...

Learn More

Golden Living operates 295 Living Centers and 12 Assisted Living Communities across the nation, caring for approximately 23,000 patients. It was facing the critical need for more efficient accounts...

Learn More

With an SaaS remote deposit capture (RDC) solution from FTNI, this multi-faceted specialty finance firm streamlined payment processing operations and gained an integrated receivables processing...

Learn MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864