Conveniently Add Mobile Remote Deposit Capture to Your Receivables Mix

Powerful mobile Remote Deposit Capture (mRDC) technology to streamline your A/R operations. Add mRDC payment solutions to your existing operations via a trusted, easy-to-use mobile application for any smartphones and mobile devices.

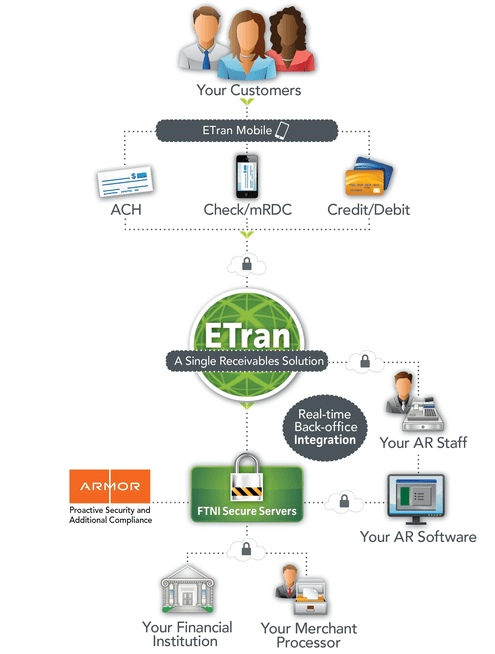

With the addition of being compatible with any bank, back-office system and mobile phone, ETran's mRDC technology quickly captures check images, associates the payments with customers' accounts, and sends the remittance data to your internal A/R staff for processing and posting—all within a single solution.

Implementing mobile payment acceptance technology allows team members to take payments anywhere, and customers to easily pay on the spot. Ultimately, mobile payment solutions assist your business in getting paid faster, and offer more value to customers with a better, simplified payment solution.

.png)