Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

ETran's modular features provide the ability to integrate with any back-office system(s), existing bank and merchant processor relationships, and check scanning hardware. Additionally, ETran's flexible embedded payment acceptance technology enables you to embed seamless and secure payment acceptance options into your existing webpages, interfaces and mobile applications.

ETran's suite of APIs and embedded payment solutions deliver your business with efficiently embedded payment acceptance capabilities that integrate with your existing user interfaces so you can tailor the payment experience to your unique brand, business processes and back-office operational workflows.

ETran's modular features provide the ability to integrate with any back-office system(s), existing bank and merchant processor relationships, and check scanning hardware. Additionally, ETran's flexible embedded payment acceptance technology enables you to embed seamless and secure payment acceptance options into your existing webpages, interfaces and mobile applications.

ETran's suite of APIs and embedded payment solutions deliver your business with efficiently embedded payment acceptance capabilities that integrate with your existing user interfaces so you can tailor the payment experience to your unique brand, business processes and back-office operational workflows.

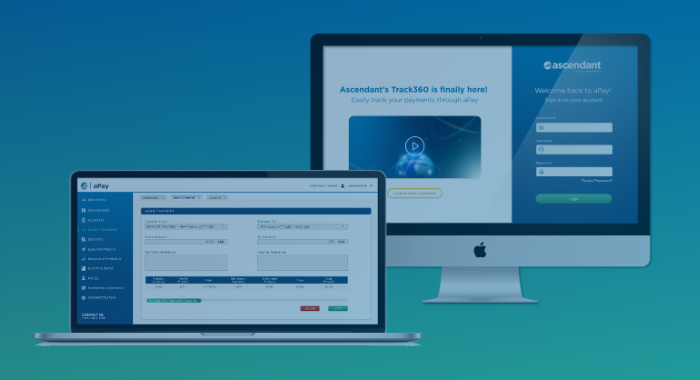

International wires matter most to the clients who depend on them. This one-pager outlines how Ascendant’s aPay integration within Q2 helps financial institutions elevate the digital banking...

Learn More

Lockbox technology isn't new—it's been around since the 1950s. It's a useful tool to help companies process payments, but it's time to move lockbox processes and technology into the 21st century....

Learn More

One of the biggest frustrations with international wire payments is losing visibility the moment funds are sent. This one-pager explains how Ascendant’s Payment Tracking, powered by SWIFT gpi, gives...

Learn MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864