Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

While new electronic payment capabilities have rippled through the industry, creating an ever-evolving landscape of payment methods and channels, checks are still king for most businesses, representing roughly half of all B2B payments according to the 2017 CRF/NACHA Payment Benchmark Survey.

Check technology is advancing with technologies like Remote Deposit Capture (RDC) and mobile RDC (mRDC). Enhanced RDC solutions let you take advantage of workflow automation to reduce the cost of manual data entry, using the technology to develop a solid check-processing foundation. What’s more, advanced RDC solutions can also act as a springboard to integrated receivables solutions that can ultimately handle all payment types and channels from a single platform.

Many point to RDC as the best kind of innovation: one that sets you up for success down the road, rather than breeding complications that only grow. Companies are wise to identify the value in moving to a single platform that can accommodate all their payments needs, both now and in the future.

But processing is only half of the equation when discussing ‘straight through processing.’ Consolidated settlement, posting, and reconciliation all have to be addressed to create a holistic integrated receivables solution.

Today's advanced check processing solutions account not only for the front end tasks of capturing check images via RDC and electronically sending them to the bank for deposit, but completely automating the back end processes of seamlessly posting remittance information into your back office A/R accounting system(s) upon transmission to your banking institution(s).

Additionally, by joining the pieces of capturing, submitting and posting check-based remittances from a single platform, you gain access to consolidated reporting and reconciliation within that same system. You benefit from greater oversight of your receivables operations and greater clarity into the business decisions that get made as a result.

By moving to a single, cloud-based, integrated receivables processing platform, you can address your current needs while also building the foundation for the strategic consolidation of your legacy systems and processes. You can develop new business process as the need for them grows, mapping them to the next stage of development as you—and your customers—are ready.

In this free eBook, learn five ways to improve your business with RDC and mRDC, including the key elements to look for in a RDC solution and the pitfalls that can lie ahead.

This eBook is designed for businesses of any size that want to save time and money by streamlining accounts receivables processes, eliminating wasted manual effort, mitigating risks with checks and, best of all, decreasing the time it takes to get your money into the bank.

While new electronic payment capabilities have rippled through the industry, creating an ever-evolving landscape of payment methods and channels, checks are still king for most businesses, representing roughly half of all B2B payments according to the 2017 CRF/NACHA Payment Benchmark Survey.

Check technology is advancing with technologies like Remote Deposit Capture (RDC) and mobile RDC (mRDC). Enhanced RDC solutions let you take advantage of workflow automation to reduce the cost of manual data entry, using the technology to develop a solid check-processing foundation. What’s more, advanced RDC solutions can also act as a springboard to integrated receivables solutions that can ultimately handle all payment types and channels from a single platform.

Many point to RDC as the best kind of innovation: one that sets you up for success down the road, rather than breeding complications that only grow. Companies are wise to identify the value in moving to a single platform that can accommodate all their payments needs, both now and in the future.

But processing is only half of the equation when discussing ‘straight through processing.’ Consolidated settlement, posting, and reconciliation all have to be addressed to create a holistic integrated receivables solution.

Today's advanced check processing solutions account not only for the front end tasks of capturing check images via RDC and electronically sending them to the bank for deposit, but completely automating the back end processes of seamlessly posting remittance information into your back office A/R accounting system(s) upon transmission to your banking institution(s).

Additionally, by joining the pieces of capturing, submitting and posting check-based remittances from a single platform, you gain access to consolidated reporting and reconciliation within that same system. You benefit from greater oversight of your receivables operations and greater clarity into the business decisions that get made as a result.

By moving to a single, cloud-based, integrated receivables processing platform, you can address your current needs while also building the foundation for the strategic consolidation of your legacy systems and processes. You can develop new business process as the need for them grows, mapping them to the next stage of development as you—and your customers—are ready.

In this free eBook, learn five ways to improve your business with RDC and mRDC, including the key elements to look for in a RDC solution and the pitfalls that can lie ahead.

This eBook is designed for businesses of any size that want to save time and money by streamlining accounts receivables processes, eliminating wasted manual effort, mitigating risks with checks and, best of all, decreasing the time it takes to get your money into the bank.

Industry-leading insurance firm leverages Financial Transmission Network’s (FTNI) ETran receivables platform to tackle credit card payments and meet substantial security requirements. Credit Card...

Learn More

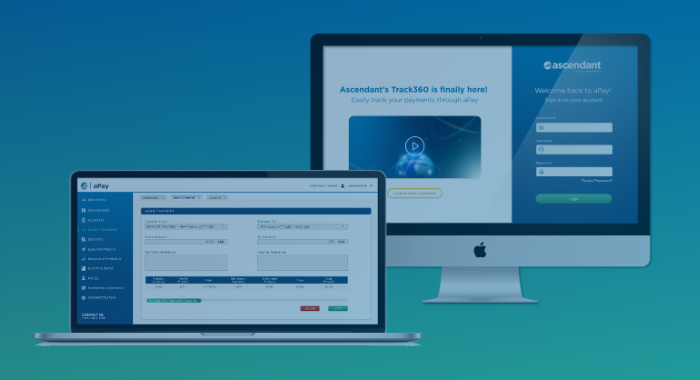

One of the biggest frustrations with international wire payments is losing visibility the moment funds are sent. This one-pager explains how Ascendant’s Payment Tracking, powered by SWIFT gpi, gives...

Learn More

Running a multi-state Distribution Company provides significant challenges, from the logistics of delivery, to accurate invoicing, simple dispute resolution and managing customers with multiple...

Learn MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864