Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

For far too long, distributors have battled highly-manual processes within their accounts receivables (A/R) operations; largely as a result of disparate, siloed technologies and systems. Along with these legacy processes and out-dated systems that support them, have come the inevitable time-consuming and error prone consequences that have kept A/R departments from meeting their full potential.

Having suffered through manual A/R processes that could take up to a week to complete in some cases, Tankersley Foodservice, the largest independent foodservice distributor based in Arkansas and Oklahoma, decided there had to be a better way.

In addition to seeking to evolve and streamline its existing A/R processes and operations, the team at Tankersley also set out to find a solution that could help them seamlessly add new payment methods and payment channels—with a particular focus on new online and mobile payment capabilities.

Starting in the second half of 2017, Tankersley Foods implemented FTNI's truly Integrated Receivables platform, ETran, to streamline their A/R processes and drive significant improvements in efficiencies within their A/R operations. Their story showcases the notable benefits new online and mobile payment capabilities have provided their customers and field representatives, in addition to their acceleration of day-to-day check processing activities.

In this episode of FTNI's True Integrated Receivables Spotlight Series, you'll discover how Tankersley Foodservice has successfully decreased DSO by more than two days while also achieving their desired ROI within just six months. Join Zac Robinson, Senior Vice President of Sales and Marketing at FTNI, and Brandy Darr, Credit Manager at Tankersley Foods, as they discuss Tankersley's search for, and adoption of, a truly Integrated Receivables platform.

For far too long, distributors have battled highly-manual processes within their accounts receivables (A/R) operations; largely as a result of disparate, siloed technologies and systems. Along with these legacy processes and out-dated systems that support them, have come the inevitable time-consuming and error prone consequences that have kept A/R departments from meeting their full potential.

Having suffered through manual A/R processes that could take up to a week to complete in some cases, Tankersley Foodservice, the largest independent foodservice distributor based in Arkansas and Oklahoma, decided there had to be a better way.

In addition to seeking to evolve and streamline its existing A/R processes and operations, the team at Tankersley also set out to find a solution that could help them seamlessly add new payment methods and payment channels—with a particular focus on new online and mobile payment capabilities.

Starting in the second half of 2017, Tankersley Foods implemented FTNI's truly Integrated Receivables platform, ETran, to streamline their A/R processes and drive significant improvements in efficiencies within their A/R operations. Their story showcases the notable benefits new online and mobile payment capabilities have provided their customers and field representatives, in addition to their acceleration of day-to-day check processing activities.

In this episode of FTNI's True Integrated Receivables Spotlight Series, you'll discover how Tankersley Foodservice has successfully decreased DSO by more than two days while also achieving their desired ROI within just six months. Join Zac Robinson, Senior Vice President of Sales and Marketing at FTNI, and Brandy Darr, Credit Manager at Tankersley Foods, as they discuss Tankersley's search for, and adoption of, a truly Integrated Receivables platform.

Industry-leading insurance firm leverages Financial Transmission Network’s (FTNI) ETran receivables platform to tackle credit card payments and meet substantial security requirements. Credit Card...

Learn More

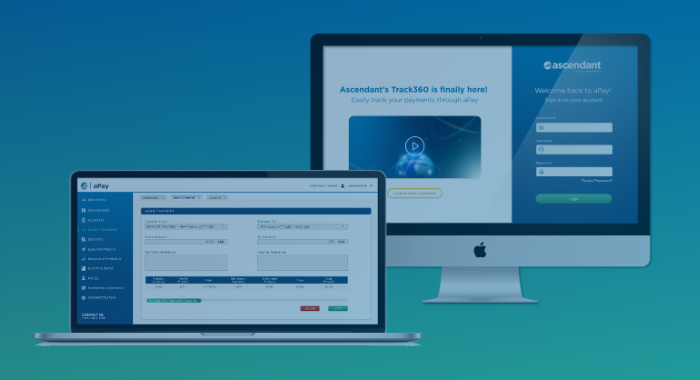

One of the biggest frustrations with international wire payments is losing visibility the moment funds are sent. This one-pager explains how Ascendant’s Payment Tracking, powered by SWIFT gpi, gives...

Learn More

International payments are no longer optional for financial institutions, but managing them in-house can be costly, complex, and risky. This brochure outlines how Ascendant helps banks and credit...

Learn MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864