Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Written by: Erin Wright

.png?width=850&height=478&name=HowToGuide_Blog%20Header%20(2).png)

Businesses are continuously seeking new ways to enhance efficiency, speed cash flow, and reduce days sales outstanding (DSO) across payment processing operations.

In this blog, we’ll provide businesses an understanding of true straight through processing (STP), and explore the key strategies and steps to help businesses achieve STP within their accounts receivable (A/R) operations.

What is true straight through processing?

True straight through processing is a streamlined approach that aims to automate and accelerate the entire A/R lifecycle from payment initiation to settlement with minimal manual intervention and touchpoints.

Understanding straight through processing

Traditional A/R processing often entails labor-intensive tasks such as manual data entry and reconciliation. True straight through processing automates the entire A/R workflow from payment acceptance to processing and posting. By minimizing manual touchpoints, STP delivers an accelerated A/R lifecycle, and real-time updates and insights into automated back-office cash application operations.

How straight through processing works

Imagine, one of your customers receives an email notification for an outstanding invoice, logs in to your business’s online payment portal, conveniently makes a payment online, and the payment information is automatically sent to your back-office system from processing and posting — all without human intervention. That is the power of true STP.

For another example, let’s consider a distribution company that receives a large volume of payments from various payment channels, including online and mobile payments, and paper checks from in-person sales representatives and delivery drivers.

With STP delivered through a modular A/R automation platform, the distribution company can streamline its payment acceptance and processing operations. Payments received through different payment channels are automatically captured, processed and posted into their back-office system in real-time. As a result, receivable processing is expedited, errors are minimized, and customer satisfaction is improved, leading to increased efficiencies and profitability.

Benefits of straight through processing

Key steps to achieving straight through processing

1. Utilize a modular platformTo achieve true STP, a ‘plug-n-play’ modular platform is a necessity as you evolve from one—or multiple—legacy systems. Today’s leading A/R automation platforms can be tailored to your specific business processes and workflows, allowing your internal receivable organization to adapt the platform with its modular solution offerings to your evolving business requirements, as well as shifting customer payment preferences.

Modular A/R automation platforms consist of independent but cohesive modules that can be added as needed, and all flowing through a single, cloud-based platform for complete oversight of incoming payments and associated remittance information. With solutions such as online and mobile payments, advanced check processing, enhanced document processing, embedded payments, AutoPay, lockbox and more, cloud-based A/R automation platforms deliver the flexibility and accessibility your business needs. By adopting a modular A/R platform, you are laying the groundwork for true straight through processing.

2. Automate cash applicationCash application automation solutions leverage seamlessly integrated technology to eliminate the traditionally manual, time-consuming, and error-prone processes surrounding data entry and reconciliation. By supporting flexible data transmission with any back-office system, businesses are able to continue to utilize their current systems while automating the cash application process through the use of a modular A/R automation platform.

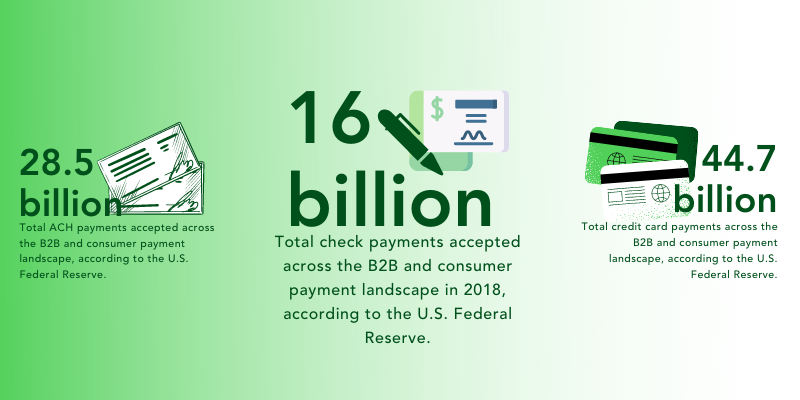

Manual payment review by your A/R team incurs unnecessary costs with each transaction, whether it's checks, ACH/EFT, credit cards, or any other form of payment. These manual processes can become even more costly and time-consuming if carried out across numerous disparate, legacy systems. With the growing number of payment methods and channels, don’t let the burden of matching payments to customer accounts fall heavily on your A/R staff. Opt for A/R automation software to intelligently and efficiently reconcile and apply payment data, reducing manual intervention and saving valuable time and resources.

3. Leverage an agnostic platformAchieving true STP shouldn’t disrupt your existing financial relationships and back-office systems (e.g. CRM, ERP, Accounting, etc.) within your organization. An agnostic platform allows you to seamlessly connect your existing banks/financial institutions, merchant processor, back-office systems, and check scanning hardware. Agnostic flexibility allows for the preservation of existing financial relationships, and any future changes, while still reaping the benefits of A/R automation. By maintaining existing relationships through an agnostic A/R solution, your business can leverage the power of STP without having to overhaul your entire receivable infrastructure.

83% of businesses updated their A/R processes and systems during, and in the wake of, the COVID-19 pandemic. Is your business leveraging software and systems that can adapt at the speed necessary to remain competitive in your market? Relying on rigid, siloed systems isn't practical and can cost you much more than frustrated customers and inefficient employees. The flexibility of an agnostic A/R automation platform helps businesses evolve without overhauling processes or having to change financial relationships, making scalability and efficiency easier to achieve in both the short, and long run.

83% of businesses updated their A/R processes and systems during, and in the wake of, the COVID-19 pandemic. Is your business leveraging software and systems that can adapt at the speed necessary to remain competitive in your market? Relying on rigid, siloed systems isn't practical and can cost you much more than frustrated customers and inefficient employees. The flexibility of an agnostic A/R automation platform helps businesses evolve without overhauling processes or having to change financial relationships, making scalability and efficiency easier to achieve in both the short, and long run.

____________________________

Optimizing A/R processes through STP is pivotal for organizations aiming to enhance efficiency, reduce DSO, and improve cash flow. By embracing a modular platform that can be tailored to your specific business needs, automating cash application, and leveraging agnostic solutions, businesses can achieve true STP without disrupting existing financial relationships. These strategies empower organizations to streamline A/R operations, minimize manual intervention, and gain real-time insights into their receivables, ultimately driving greater success and financial stability.

____________________________

1. PYMNTS, "Companies Tap New Data Insights After Automating Business Payments" | 2023

The Modernization of Check Acceptance, Proliferation of Electronic Payments, Automated Cash...

Read More

5...4…3…2…1… As we count down towards the new year, there’s no better time for businesses to pop...

Read More

Over the years, accounts receivable (A/R) organizations have routinely utilized multiple, disparate...

Read MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864