Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Written by: Erin Wright

.png?width=1000&height=500&name=New%20Years%202023%20Blog%20Image%20(6).png)

In this blog, we’ll uncork the common pain points that many businesses face within A/R operations and processes, and toast to the resolutions that will alleviate those pain points and elevate payment acceptance, processing and posting for your organization. From streamlining paper-based receivables to prioritizing customer-centric payment options, this blog aims to guide businesses towards A/R acceleration and automation in the new year.

Payment Processing Pain Points & How to Resolve Them

1. Paper-based Receivables: Ditch the Paper Parade of Manual Processing & Ring in the New Year with Faster A/RLike a champagne cork stuck in a bottle, paper-based receivables - including check payments, remittance documents and statements/invoices - have historically slowed A/R processing.

Many businesses lack the technology to efficiently accept and process paper-based receivables, leaving internal staff to spend precious resources, effort and time on manually processing and posting payments and associated remittance documents. It’s time to bid farewell to the paper parade and manual receivable processing, and ring in the new year with faster A/R.

Advanced Remote Deposit Capture (RDC) and Enhanced Document Processing (EDP) solutions allow your business to speed paper-based payment processing and back-office cash application operations.

Advanced RDC solutions deliver businesses with the ability to scan checks while seamlessly viewing, associating and storing all account and payment information in a secure, compliant and central location. A/R teams are able to drastically reduce administrative time spent on processing checks (and associated remittance documents), with the added benefit of reducing costs and risk associated with previously manual check processing operations.

With EDP solutions, internal staff are able to scan or upload remittance documents along with associated payments to a single user interface to automate the capture and extraction of invoice and remittance data from documents. Utilizing AI to capture and read semi-structured remittance documents, EDP solutions help to eliminate manual data entry and reduce errors across A/R processing.

Don’t let the paper parade slow you down in the new year. Start 2024 off right by ditching the manual payment and document processing, and raising a glass to streamlining your A/R operations.

2. Lack of Multiple Payment Options: That’s So Last Year, Update Your Receivables Mix in the New YearWhile the clock ticks down on New Year’s Eve, your customers have been wishing all year for more ways to pay.

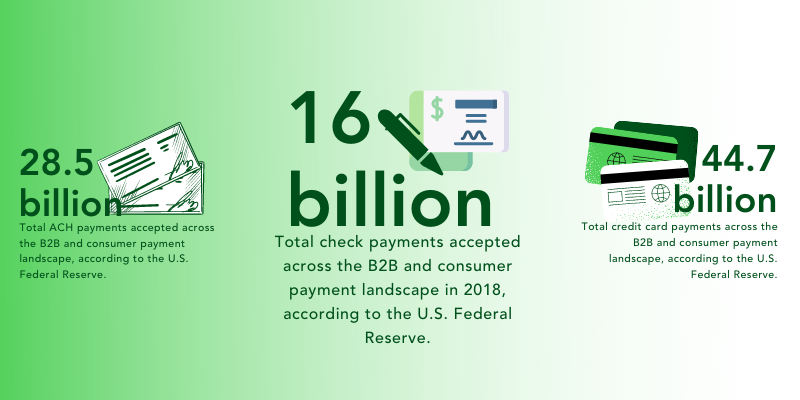

Consumers have become increasingly accustomed to the ability to make payments whenever and wherever they want across multiple payment methods (ACH/EFT, credit/debit card, cash, check) and channels - and the same goes for your customers. Your customers desire the ability to make payments on their account in the way that is most convenient to them, whether that’s online, via a mobile app, in person or over the phone. By utilizing a modular payments platform that allows your business to implement multiple payment acceptance solutions as you go, you are able to deliver your customers with the payment options they want and need.

A/R automation solutions enable your business to start where you and your customers’ needs are today and seamlessly expand the use of the platform over time.

For example, let’s say your business still receives a large majority of payments in the form of paper checks (which we know is the case for many businesses still). Chances are that you, and some of your customers, would like to transition to electronic payments. With an A/R automation platform, your business is able to conveniently and securely add electronic payment channels such as online payments and AutoPay to fill this need for your organization, as well as your customers.

But, the party doesn’t stop there. Your business can also expand upon these payment channels to include mobile payment acceptance, embedded payment solutions, and more. With the addition of new payment channels to your existing receivables mix, your organization is able to expand customer payment options while also maintaining current solutions - all from a single platform.

Ultimately, A/R automation software fits your business and customers - not the other way around. Don’t miss out on the party in 2024, countdown to convenience by adding multiple payment options to meet the needs of your business and your customers.

3. Manual Cash Application & Reconciliation: Don’t Let A/R Processing’s Ball + Chain Drag You DownLike we always say, each time your A/R team has to manually review a payment, it costs you money. Manual cash application and data entry are holding your business back – don’t drag the inefficiencies of time-consuming, error-prone A/R processes into the new year.

With cash application automation, your business is able to streamline and automate cash application and reconciliation processes, and elevate exception handling. Internal staff no longer is tasked with manually matching payments to customer accounts and keying in important payment details. Instead, A/R automation creates business rules and workflows to automate the matching of payments to customer accounts for automated posting to any back-office system.

Automated cash application will kickstart your organization to true straight through processing for the new year and beyond. Don’t waste any more valuable time dragging your A/R processing down – automate your cash application operations today.

Don’t Drop the Ball, Start the New Year Right

Forget unrealistic resolutions, and embrace the reality of A/R automation. As we ring in the new year, it’s time for your business to cater to customer payment preferences, streamline back-office cash application operations, and ultimately, accelerate your entire A/R lifecycle.

Through the adoption of A/R automation solutions, your organization can speed payment processing, reduce errors and save costs. The countdown is on for your business to implement and integrate a payments platform to deliver these benefits to your team and your customers. It’s time to raise a toast to better A/R in the new year.

Happy New Year!

___________________________

1 The Federal Reserve, FedPayments Improvements "Modernizing B2B Payments: The Time for Digitization is Now" | 2023

2 PYMNTS, "PYMNTS Intelligence: Why the Time for A/R Automation is Now" | 2023

The Modernization of Check Acceptance, Proliferation of Electronic Payments, Automated Cash...

Read More

Boo! Halloween is just around the corner, and we thought it’d be the perfect time to scare away...

Read More

The evolution of payment methods, channels and customer preferences across the B2B payments...

Read MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864