Discover True Integrated Receivables Treasury Solutions For Banks & Financial Institutions

If there's one thing we have learned over the history of our business, it is that no two businesses' A/R processes are the same. There is no proverbial "box" that you can fit companies and their associated processes into.

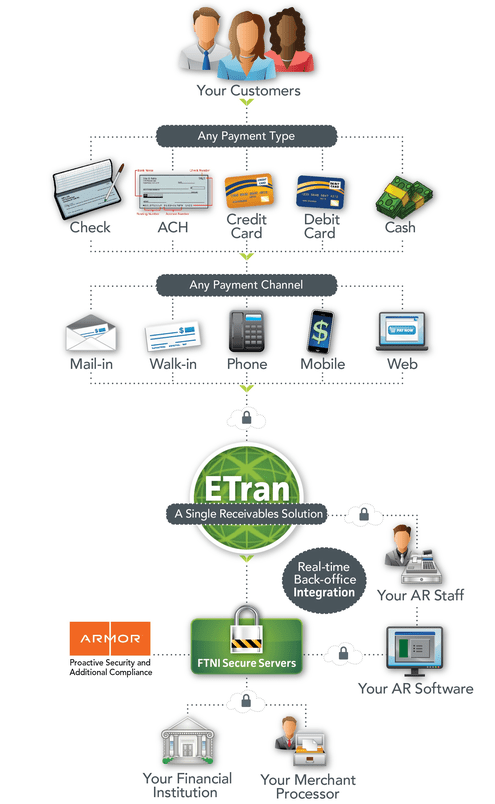

If there's been a second thing we have learned, it has been that the use of numerous, disparate systems, services and manual processes used across many industries, including treasury and finance, to accept and manage customers' and clients' payments are inefficient and expensive to maintain.

Learn how banks can put an end to disparate processes and make the jump to a trusted technology advisor and business partner. You build the relationships, we’ll bring the technology, and your corporate treasury customers will achieve the game-changing results and costs savings. For more information, download our Integrated Receivables for Banking & Treasury eBook today.

.png)