Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Written by: Ashton Steffl

“Out with the old, in with the new.”

While this common phrase may apply to most things in our consumer lives—updating to the newest iPhone release, trading your gas-powered car for a hybrid or electric vehicle, or always moving on to the “bigger and better” version of something—it most certainly doesn’t pertain to the paper check, across businesses and consumers alike. As we will discuss in this post, while the check may be one of the “older” methods of payment, it isn’t going to be out of use anytime soon.

What businesses need now are new solutions and processes to help them achieve improved levels of efficiency in their acceptance, processing and posting of this predominant payment method–while also building a modern A/R technology stack that provides seamless access to popular electronic payment methods and channels.

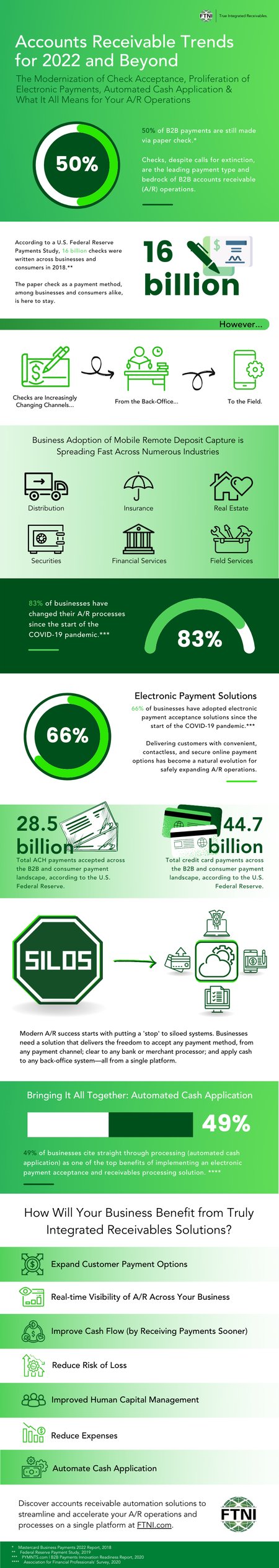

Even though the rise of electronic payment methods (ACH/EFT, credit/debit card) and channels (online, mobile) has led to a general decline in the usage of paper checks, their total downfall is nowhere in sight. And despite calls across some technology providers and the media for checks to become extinct, they haven’t been eliminated yet. According to Mastercard’s Business Payments 2022 report, 50% of B2B payments are still made via paper check.1 Regardless of the growing adoption of electronic payment methods among businesses, the check is here to stay. And the time to become more efficient in your A/R processes associated with check payments is now.

Even though the rise of electronic payment methods (ACH/EFT, credit/debit card) and channels (online, mobile) has led to a general decline in the usage of paper checks, their total downfall is nowhere in sight. And despite calls across some technology providers and the media for checks to become extinct, they haven’t been eliminated yet. According to Mastercard’s Business Payments 2022 report, 50% of B2B payments are still made via paper check.1 Regardless of the growing adoption of electronic payment methods among businesses, the check is here to stay. And the time to become more efficient in your A/R processes associated with check payments is now.

Furthermore, according to the U.S. Federal Reserve Payments Study, 16 billion checks were written across businesses and consumers in 2018.2 Regardless of the calls for extinction around checks, the foundational payment method across the payments landscape continues to persist.

However, as we’ve seen in more recent years, checks are increasingly changing channels from the back-office, to the field and front-office as new mobile remote deposit capture technologies increase in adoption within the A/R operations of companies spanning multiple industries. As with many things, the natural evolution of technology and processes occurs based on the demands and desires of consumers, along with conditions (i.e., the ongoing global COVID-19 pandemic), in the marketplace.

Throughout the history of payments, the evolution of the most popular method has been driven by one major thing: convenience. True to form, checks were essentially derived as an alternative for the historical method of carrying around sacks of coins, and later, stacks of cash. Consequently, payment methods have continually been replaced or phased out by methods and channels that were even more convenient than their predecessor. But, in the end, some of the “old” methods seem to be hard to shake.

Here at FTNI, we passionately believe that it’s not about the elimination of “old” or “outdated” payment methods and channels altogether–especially when they still may be preferred by a majority of your customers. Rather, it’s about evolving your A/R processes and technologies to maximize efficiencies for “old” and “new” payment methods and channels from a single platform. So as your customers’ payment preferences change, you’re ready to provide convenient, secure payment options no matter how they choose to pay—all without having to bring on unnecessary cost and complexity associated with a patchwork quilt of vendors and systems.

As receivables organizations continue to evolve, the way checks are accepted, processed, posted, and managed continues to change as well. Due to the increased availability of mobile payment acceptance solutions in the B2B marketplace, check processing is increasingly changing channels from solely back-office operations, to field and front-office receivables acceptance and processing.

Since the start of 2020, over half of FTNI’s new customer implementations have included mobile remote deposit capture (mRDC) solutions. Business adoption of mRDC functionality is spreading fast across numerous industries. For example, at FTNI, we have seen rapidly increasing adoption across distribution, insurance, real estate, securities and financial services, field services, and more. What’s more, from 2019 to 2021, mobile remote deposit capture volume increased more than 140% on the ETran platform as customers have rapidly shifted check capture from the back-office, to check acceptance in the field via mobile devices. And that growth is forecast to continue with 100% YOY growth in 2022, as well.

Evolving your A/R processes with this transition from back-office desktop check scanning and processing to mobile check capture solutions in the field enables businesses with the ability to provide an efficient and secure way for employees to accept payments on the spot, while also streamlining and accelerating back-office cash application operations across your organization. By delivering your field team members with the ability to quickly and securely accept checks via a mobile device, you are able to accelerate the acceptance, processing and posting of paper-based receivables—moving the payment from the hands of your customers to your bank, and ultimately your back-office system(s) in one seamless movement (i.e. straight through processing).

Even though check payments are here to stay, there is no denying that electronic payment methods and channels are a burgeoning force within receivables operations. According to a recent PYMNTS.com report, 83% of businesses have changed their A/R processes since the start of the COVID-19 pandemic.3 As we’ve seen with many things throughout the pandemic, changes have been required at a rapid pace in order to adapt to the hyper disruption and social distancing that 2020 and beyond has brought us—and A/R processes and operations have been no exception.

Since the start of the pandemic, contactless, electronic payment acceptance has continually increased. According to the same PYMNTS.com report, 66% of businesses have adopted electronic payment acceptance solutions since the start of COVID-19. Very much in line with industry data, here at FTNI, since the start of 2020, 60% of our new customer implementations have included electronic payment solutions of some sort (e.g., online, mobile, API, autopay, etc.).

Delivering your customers with convenient, contactless electronic payment options during the ongoing pandemic allows them to securely and safely make payments on their account while also keeping your internal employees, and customers, safe. With the added benefit of electronic invoicing capabilities built into many integrated online and digital payment solutions, customers are able to easily view, select, and pay outstanding invoices. Again, according to the aforementioned PYMNTS.com report, since the start of the pandemic, 64% of companies have shifted away from physical invoices and started utilizing electronic invoice presentment and payment (EIPP) capabilities.

Electronic Invoice Presentment and Payment functionality, in conjunction with digital payment solutions, gives your A/R organization the opportunity to shift most of your paper-based receivables online, adding to an even safer and more secure environment. Similar to checks changing channels from desktop scanning to mobile check capture, moving payment acceptance online is a natural transition as B2B payment methods and channels continue to trend increasingly towards electronic solutions.

According to the U.S. Federal Reserve, in 2018, there were 28.5 billion total ACH payments accepted across the B2B and consumer payments landscape, as well as 44.7 billion total credit card payments accepted. It’s clear that electronic payment methods are increasingly growing. But don’t be fooled, as we mentioned previously, there are still billions of checks to be accounted for within businesses’ A/R processes.

While continually evolving your receivables processes to meet your customers needs, and keeping up with the natural shifts in the payments landscape can easily lead to increasing complexity and rising costs, it doesn’t have to. You can put a ‘stop’ to silos in your A/R operations with the help of truly integrated accounts receivable automation solutions.

Modern A/R success begins with putting a ‘stop’ to siloed, legacy systems and processes by integrating solutions into your receivables operations to maximize automation. Businesses need a solution that delivers the freedom to accept any payment method, from any payment channel; clear to any bank or merchant processor; and apply cash to any back-office system—all from a single payments platform.

According to a 2020 Association for Financial Professionals’ survey, 49% of businesses cite straight through processing (automated cash application) as one of the top benefits of implementing an electronic payment acceptance and receivables processing solution.4 Providing your A/R team with the tools to achieve straight through processing is just one piece in evolving your receivables to adapt to an ever-changing payments environment.

Implementing an integrated receivables platform and offering a convenient variety of payment channels to your customers, all on a single solution, gives your internal A/R team complete, centralized oversight of all incoming payments and receivables activity in one place. Greatly improving your ability to ensure that your A/R team is able to optimize their productivity by focusing on the highest value functions.

Truly integrated receivables technology delivers your business with a host of benefits including…

Accounts receivable automation solutions provide businesses with the solutions they need now, while simultaneously offering the ability to easily deploy new payment acceptance capabilities in the future as customer preferences and the overarching payment technology landscape continues to evolve.

As we head further into the new year, there really is no better time than now to take a look at your receivables processes and systems to determine what your unique path towards A/R automation and modernization looks like. Your customers will thank you. Your A/R team will thank you. Your CFO will thank you. Sounds like a winning combination to us.

__________________________________________________

1 Mastercard Business Payments 2022 Report, 2018

2 Federal Reserve Payment Study, 2019

3 PYMNTS.com | B2B Payments Innovation Readiness Report, 2020

4 Association for Financial Professionals' Survey, 2020

Over the years, accounts receivable (A/R) organizations have routinely utilized multiple, disparate...

Read More.png)

Businesses are continuously seeking new ways to enhance efficiency, speed cash flow, and reduce...

Read More

Ninety-two percent of B2B organizations are digitizing their payment solutions.1 Over the past...

Read MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864