Contact Sales (402) 933-4864

US companies are wasting $1 billion each year because their receivables and payment processing systems are siloed and overly complex. It’s a grim picture, and it’s not improving nearly as fast as it could be. In the burgeoning digital age, consumers...

Read More

Part 2 of the 3-part True Straight Through Blog Series To sum up the payments problem: Clients are using multiple...

Read More

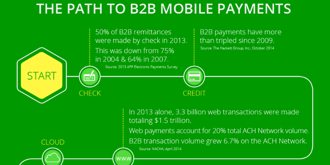

There’s never been a better time to start taking advantage of the new technologies that are emerging within B2B...

Read More

Part 1 of the 3-part True Straight Through Blog Series Here at FTNI, we’ve been in a lot of conversations lately...

Read More

Whether you’re one of the world’s largest corporations, a small Internet store or somewhere in between, doing business...

Read More

Today’s growing portfolio of payment channels continues to add new levels of complexity to payment processing—often...

Read More

Once upon a time, when a customer decided to pay with a check, the business receiving their payment would deliver that...

Read More