Online Payment Processing Solutions

Simplify Online Payment Acceptance & Increase Customer Convenience with Contactless Online Payment Options, EIPP Solutions & More.

Contact Sales (402) 933-4864

Simplify Online Payment Acceptance & Increase Customer Convenience with Contactless Online Payment Options, EIPP Solutions & More.

Payment processing operations continue to evolve as new technologies enter the payments landscape, adding to an already diverse and complex accounts receivable (A/R) environment. Legacy payment systems and traditional receivable processes simply cannot keep pace.

Offering self-service, online payment processing solutions is a natural extension and evolution for your expanding A/R processes. By adding the ability for your customers to make contactless payments online, they gain the convenience to safely and securely make payments when and where they want, and your A/R team gains complete oversight of all digital payments from a single, cloud-based user interface.

Give your organization, and customers, the control and oversight needed by leveraging a seamlessly scalable SaaS platform that delivers convenient, contactless online payment options.

Growing your business means growing transactions, and that means finding new ways to streamline A/R processes while integrating new, highly-secure payment technology and processes along the way. As digital payment solutions are continuously added to the B2B landscape, sifting through new online and electronic payment gateways is becoming more complex.

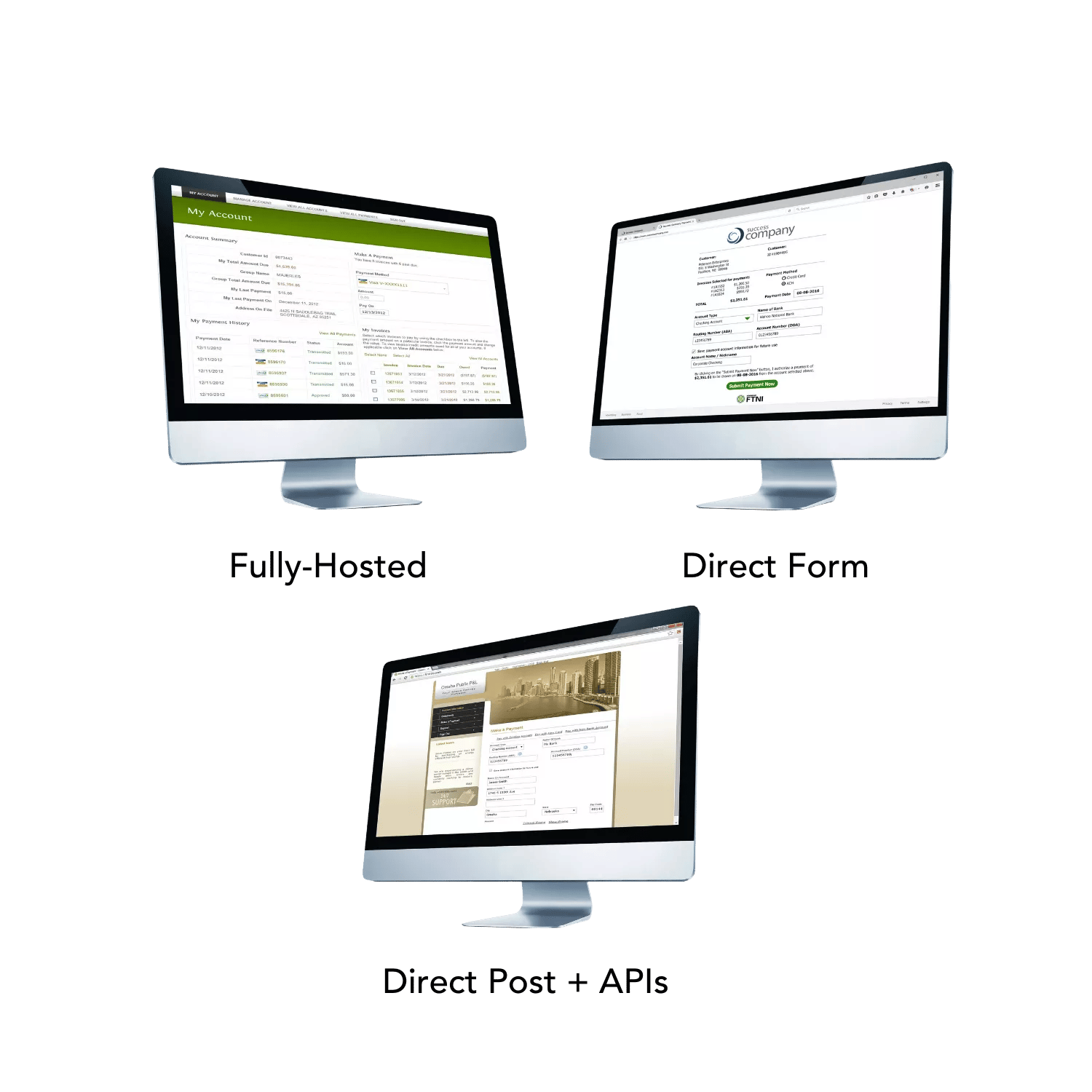

Improve your online payment acceptance capabilities with accounts receivable automation software. FTNI's ETran Online Payment solutions deliver multiple ways to securely accept one-time and recurring online ACH and credit/debit card payments and automatically post transaction details to your back-office accounting, ERP or CRM platform(s). With three different online solution offerings—Fully-Hosted, DirectForm, and DirectPost—you are able to implement and integrate the solution that fits your unique business processes, workflows and desired user experience.

Featuring three unique online payment solutions, ETran, delivers the flexibility to utilize your existing bank, merchant processor and back-office relationships to manage the complete payment acceptance, management and cash application lifecycle on a single platform.

ETran’s fully-hosted online payment portal allows you to deliver your customers with an easy-to-use, contactless, online payment solution that is white labeled with your branding, but hosted on FTNI’s secure, fully-compliant, cloud-based infrastructure.

Mobile responsive and featuring complete electronic invoice presentment and payment (EIPP) capabilities, ETran's fully-hosted online payment portal allows your customers to conveniently view, select and pay summary-level or original PDF versions of their open invoices via any device.

DirectForm allows businesses to remain in complete control of the user experience within your own webpage, right up until the acceptance of payment information. This includes the presentation of invoices and invoice data, selection of invoices/statements to be paid and the total amount to be paid.

When the customer is ready to submit a payment, they are presented with a secure page that’s hosted on FTNI’s secure and compliant servers. This page is able to be white labeled to reflect your branding for a cohesive user experience.

Accepting ACH/EFT and credit/debit card transactions via your existing website or customer portal has never been easier—or more secure—with FTNI's DirectPost embedded payment acceptance component.

Leveraging FTNI's proprietary DirectPost online payment acceptance services, your web development or IT team can quickly and easily embed ETran’s secure payment acceptance component directly within a payment page on your website, giving you complete control over the entire user experience from beginning to end.

Each of ETran's unique online payment solutions support our strategic mission of delivering truly integrated receivables solutions that seamlessly integrate with any back-office system in either batch or real-time to streamline and automate the cash application process.

One-time, recurring, or future scheduled payments are all supported within ETran's suite of online payment solutions. ETran's fully-hosted payment portal also supports self-service options for customers to set-up AutoPay (automatic debit) payments based on invoice due dates.

Once a credit card or ACH payment has been accepted through any of ETran's online payment solutions, payment details are immediately passed to the ETran desktop user interface, where your internal A/R team will benefit from additional oversight, workflow management, and reporting capabilities of all payments that have been made online, as well as any payments made through other modules available on the ETran platform.

As is consistent with all modules on the ETran platform, ETran's online payment solutions maximize flexibility and scalability within your A/R operations by working with your existing bank(s), merchant processor, and back-office systems.

Having an agnostic receivable system means you don’t have to change platforms or rebuild existing processes as your business, financial or back-office technology needs change today, tomorrow and years into the future.

Reduce risk and enable enhanced security. With ETran's cloud-based architecture, you get the unique benefits of multiple layers of compliance and proactive security.

First, you'll gain HIPAA and PCI compliance directly at the ETran site layer. Second, you'll benefit from industry-leading proactive security and an additional layer of compliance (PCI, HITRUST/HIPPA, SSAE16 and more). For more information, visit our hosting partner, Armor.

The ETran platform caters to businesses' internal A/R users by providing robust search and reporting tools. ETran's search and report services are designed to fit businesses' unique requirements, and can provide actionable insights and detailed transaction information.

A/R users can run reports based upon a variety of selected areas including payment dates and date ranges, specific online transactions and other transaction data, account information, and more.

On-demand, contactless online payment acceptance and management of ACH and credit card payments.

Complete EBPP/EIPP invoicing options—choose between simulated or full invoice presentment.

Easily and securely accept one-time or recurring ACH, credit/debit card transactions.

Accept, process, and post payments and associated remittance information in a single pass.

ETran's Electronic Invoice Presentment and Payment (EIPP) capabilities deliver the ability for customers to view and pay outstanding invoices within their customer account through the fully-hosted online payment portal. Capable of receiving open invoice information via batch or real-time API calls, ETran's fully-hosted online payment portal supports the ability to present line item or summary invoices for customers to conveniently view, select and pay one or multiple invoices.

FTNI's electronic invoicing features and modular platform offer a single, end-to-end solution that will move your paper-based receivables to a single, cloud-based platform. What's more, ETran's unique ability to ensure true straight through processing delivers your A/R team with automated feeds of all payment data and associated invoices for posting into any back-office system(s).

“FTNI has truly transformed our payment processing and collection procedures, providing us with the tools we need for efficient and seamless financial operations. Since implementing a new online payment solution with FTNI, we have noticed an increase in customers going online to make payments

independently."

Wright Beverage Distributing

In this free eBook, learn 6 essential tips to help prepare your business for online payments, including the key criteria that should be considered when determining a payment solution that’s right for you.

Payment processing continues to evolve, adding to an already complex and diverse payment landscape. Learn how to streamline your payment acceptance with online solutions.

This free eBook delivers a handy checklist for identifying and selecting a truly integrated receivables solution to meet your business needs. Discover true integrated receivables today.

The best way to take payments online is through a solution that fits both the unique needs of your business, as well as your customers. With several different online payment options, FTNI delivers your business the ability to find the right solution for your needs. Whether you’re looking to utilize a fully-hosted online payment portal, an integrated payment component or a secure payment page, providing your customers with a convenient, contactless online payment solution creates a better, more secure user experience for your customers while helping your internal A/R team to streamline payment acceptance, processing and posting.

The processing of all online payments is handled by your merchant processor, bank and third-party technology provider. Once you have an online payment solution in place, your customers are able to make payments via ACH and/or credit card, and you don’t have to touch any secure payment data.

FTNI is merchant processor agnostic, so we don’t require your business to work with a specific merchant processor relationship. The best payment processor depends on your business’ unique needs; FTNI will work with any of your existing and future relationships.

According to a U.S. Federal Reserve Payments study, the most popular online (electronic) payment method across businesses and consumers is credit cards, with ACH payments being the second most popular.

There are several ways for businesses and consumers to make payments including: check, credit card, debit card, ACH, cash. However, the most commonly used payment methods across the B2B payments landscape are check, ACH and credit cards.

The safest way to receive payments online is by working with a third-party technology provider that delivers complete security and compliance across their online payment and accounts receivable solutions.

Credit cards are commonly referred to as the most secure payment method due to their online security features such as encryption and fraud monitoring.

Financial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864