Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Written by: Erin Wright

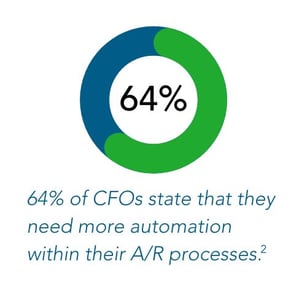

The way businesses manage payment acceptance and processing within accounts receivable (A/R) operations is constantly evolving. And, for every business, this constant evolution brings new benefits, but can also present some challenges for A/R operations and processes. Many businesses haven’t kept pace with the new technology and solutions entering the payments landscape, and have instead cobbled together multiple, siloed legacy systems and dashboards to manage their receivable processes. With different payment methods and channels being applicable to different businesses across numerous industries, and customers continually asking for additional payment options, it’s time for businesses to evolve. It’s time for your A/R processes and software to keep pace with the evolution of payment acceptance and modern automated back-office cash application solutions.

Accounts receivable automation software delivers your organization with the ability to accept any payment method, via any payment channel from a single, cloud-based platform. No more managing various payment systems and dashboards to handle numerous incoming payments. A/R automation software allows your internal A/R team to have complete oversight of all payments from a single user interface to streamline payment acceptance, processing and cash application. In order to keep pace and continually automate your business’ unique processes and workflows, A/R automation platforms are the way forward. Truly integrated A/R processing platforms can:

Additionally, A/R automation software is not one-size-fits-all. Today’s leading A/R automation platforms are seamlessly scalable and configurable to your unique business processes and A/R operations, providing your business with a modular solution suite that fits your needs both today and years into the future.

Now is the time to modernize and accelerate your A/R operations with accounts receivable automation software, and discover the true benefits that it brings. In this blog, we’ll discuss the benefits of automating your receivable operations by implementing an A/R automation solution, the challenges that it can present, and ultimately, how to decide on the right solution for your business.

Let’s jump in.

The Benefits

Streamlined Payment Processing & Automated Cash Application

Despite A/R automation solutions being available for over a decade and a half (often called "Integrated Receivables Solutions"), many businesses are still stuck using outdated, disconnected legacy systems, spreadsheets, and dashboards to manage their receivables. These systems can't automate payment acceptance, deposits, or cash application, and they lack the ability to provide seamless straight-through processing from a single platform. As a result, A/R teams end up manually extracting data from various sources to reconcile daily activities.

By choosing and implementing a truly integrated A/R automation platform, businesses can enjoy a flexible, scalable payment processing solution. This move from outdated systems to modern A/R automation simplifies payment processing, allowing acceptance of any payment method from any channel and automatic posting of transaction details to back-office systems.

Moreover, A/R automation software can reduce or eliminate many of the manual, error-prone tasks associated with legacy receivable processing. Here are some examples of A/R automation solutions that can streamline your payment processing operations and benefit your organization.

Increased Cash Flow & Reduced DSO

Implementing an A/R automation platform delivers your business with a seamlessly scalable, modular solution suite that meets the needs of not only your unique business processes, but those of your customers, as well. Including solutions such as mobile and online payment acceptance, automatic debit (AutoPay), advanced check processing, enhanced remittance document processing, and embedded payment technology, A/R automation platforms can help your organization to increase cash flow and reduce days sales outstanding (DSO).

With self-service online payment options, you are able to deliver your customers convenient, contactless access to make payments 24/7. By adding the ability for customers to make payments online, they gain the convenience to safely and securely make payments on time, any time, without having to rely on your A/R team to manually send invoices. In turn, this helps your organization to get paid faster, speeding cash flow and reducing DSO.

In addition, automatic debit (AutoPay) solutions can easily be set up within an online payment portal to facilitate automatic ACH/EFT and credit/debit card payments based on customers’ unique payment terms and open invoices. AutoPay solutions give you the ability to send payment reminders detailing the invoices to be paid and upcoming payment dates.

.gif?width=352&height=352&name=DSOgraphic_Blog%20(2).gif) Mobile payment acceptance solutions are especially powerful in helping organizations reduce DSO by allowing field team members, delivery drivers and sales representatives to accept payments on the spot. With mobile remote deposit capture (mRDC), ACH/EFT and credit/debit card acceptance capabilities, your field team members can securely accept payments in the field, get money to the bank faster, and cut down DSO periods significantly.

Mobile payment acceptance solutions are especially powerful in helping organizations reduce DSO by allowing field team members, delivery drivers and sales representatives to accept payments on the spot. With mobile remote deposit capture (mRDC), ACH/EFT and credit/debit card acceptance capabilities, your field team members can securely accept payments in the field, get money to the bank faster, and cut down DSO periods significantly.

Providing your customers with convenient, secure, and easy-to-use payment options is the solution to speeding your cash flow and reducing DSO. As your business evolves with the demands of your customers, it’s important to look for solutions that will effectively and efficiently operate within your current A/R operations.

Agnostic by Design

Any bank. Any merchant processor. Any back-office system. Any check scanning hardware.

Today's business environment is complicated enough without having to fit into some "box" created by your software and systems. Not to mention the inevitable changes that will undoubtedly come your way over the years. Leading A/R automation platforms will provide you with the flexibility to easily change banking institutions, card processors, back-office systems and more. All without having to completely recreate your A/R operations each time a change is made to one of those supporting systems or relationships.

Workflow Automation & Complete A/R Oversight

Once all of your receivables are flowing through a single platform, you’ll be able to dramatically improve efficiencies through the use of workflow automation to help A/R staff focus on more strategic tasks by automating time-consuming and repetitive tasks such as matching payments to paid invoices and cash application into back-office systems. Additionally, A/R automation solutions will help you gain a holistic picture of all your data and trends, aging reports and more. This information can be used to improve A/R performance and make better business decisions.

Lightning Round – 6 More Quick-hitting Benefits:

The Challenges

While we are admittedly believers in the benefits of A/R automation solutions far outweighing the challenges, we also think it is important to call out a few challenges that are worth being aware of as you evaluate potential solutions and the impact this technology can have within your business operations.

Change

Change within business processes will always be one of, if not the most significant challenge to overcome when looking to implement a new technology. Your staff will need to overcome the challenges of learning how to successfully oversee and manage a new system and fight the urge to simply make your new system do what the old one did. This can present challenges for team members who are accustomed to doing the majority of payment processing and cash application manually. Remember, you made the switch for a reason. Assuming you made the correct selection of a new A/R automation partner, not long after the switch to your new platform, your team will take notice of how much time savings is occurring within receivable operations, freeing up more time for crucial tasks such as exception handling.

In order to be prepared for any initial challenges implementing a new solution can present, it’s important to consider having good change management processes in place. Here are a few tips:

Cost

As with anything valuable, you get what you pay for. If you’re seeking the lowest cost solution, you’re likely to also get the lowest value solution. The cost of your chosen software will vary depending on the features and functionality required, as well as usage metrics such as number of transactions, number of users, etc. Regardless, look for clear and easy to use pricing structures. If it seems like the price is too high, it probably is. Finding alignment between the operational improvements you’re seeking and the price you’ll be paying on a monthly or yearly basis should rationally align. You’ll know it when you see it. Especially after you evaluate pricing from several potential partners.

Complexity

Accounts receivables as an operation can be complex. But that doesn't mean that your chosen A/R software has to be complex to implement and use. It’s important to choose a software solution that is easy to use and meets the specific needs of your business. Your chosen partner should be able to bring best practices from experience working with other customers in your same industry that will help you be successful. Dashboard driven solutions are a great example of unnecessary complexity within A/R solutions. The dashboards may be pretty to look at, but if you can’t easily access the actual payments and supporting metadata within the same platform, you’ve just inadvertently added silos and complexity to your environment.

Integration with Existing Systems

Your chosen A/R automation software needs to be able to integrate with your existing accounting and ERP systems. This can be a complex and time-consuming process, especially if your existing systems are old or outdated. Make sure that your chosen partner isn’t tied to only a small number of back-office systems. Ideally, you should be with a partner who can connect to any system in either batch or real-time (API) integrations. That way when/if the time comes in the future to change your back-office system(s) you’re not left to rip and replace more than one system due to a lack of integration options.

Anytime you’re looking to implement new technology within your business, there are going to be challenges to consider. But despite the challenges, as we’ve made a clear note of earlier in this post, the benefits of implementing A/R automation software greatly outweigh the challenges. And, it can provide a number of key benefits for businesses, including improved cash flow, reduced DSO, and fewer errors. By carefully considering your needs and choosing the right software partner, your business can overcome the challenges and quickly reap the rewards of moving to a truly integrated A/R automation solution.

How to Decide on the Right Solution for Your Business

It’s no secret that the technology market is saturated with solutions, systems and platforms. You know that your business is unique, and it presents its own needs and challenges when it comes to your customers and A/R operations. So, how do you decide the right technology partner and platform for you?

After reviewing the benefits of selecting and implementing an A/R automation solution, as well as some of the challenges it can present, the next step is deciding the right platform and technology provider that best fits your business and its unique receivable processes.

Here are a few more tips and considerations to keep in mind when looking to evaluate and select an A/R automation platform and partner:

____________________________

Embracing A/R automation software isn't just a wise business decision; it's a strategic move that aligns your company with the dynamic nature of the B2B landscape. It's a bold step towards ensuring your business remains competitive and relevant in the face of ever-changing customer demands and industry advancements. So, seize the opportunity, adapt to the times, and invest in the future of your business. With accounts receivable automation, you'll not only save money, time, and resources but also empower your team to work more efficiently and effectively. The future is now, and it's brimming with potential. Don't just be a spectator; be the driving force behind your business's success. Take action, innovate, and watch your business thrive in the evolving world of B2B commerce.

1 PYMNTS, "How Automations Reduce Receivables Delays" | July 2023

2 PYMNTS, "Why the Time for A/R Automation is Now" | October 2023

The evolution of payment methods, channels and customer preferences across the B2B payments...

Read More

Boo! Halloween is just around the corner, and we thought it’d be the perfect time to scare away...

Read More

Checks Changing Channels, Online Payments Proliferation, Automated Cash Application & How...

Read MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864