Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Written by: Erin Wright

.png?width=848&height=477&name=Blog_Image%20(4).png)

In 2025 A/R Automation Proved Its Value

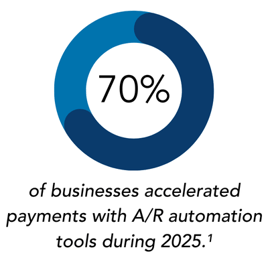

For years, the finance world has talked about the digital transformation of accounts receivables (A/R). According to research from PYMNTS, nearly 70% of businesses accelerated payments with A/R automation tools during the year.¹ That shift was driven by necessity as much as innovation. Manual processes simply can’t keep up with economic and operational challenges.

Despite automation’s rise, inefficiencies remain. Studies find that 39% of B2B invoices in the U.S. were still paid late,² and nearly 60% of global businesses reported that over half their receivables were overdue at some point during the year.³ For A/R teams, that means one thing: the cash flow gap isn’t closing fast enough.

But where automation has taken hold, results are measurable. Companies using digital invoicing, online payment portals, and automated reconciliation solutions saw DSO reductions of 10–20%,⁴ and manual workload reductions approaching 80%.⁵ Those numbers don’t just represent speed, they represent control.

Looking ahead, 2026 won’t just continue the trend. It will accelerate.

Beyond the numbers, 2025 taught important lessons about what makes A/R automation truly effective.

1. Unified integration beats fragmentation.

The hesitancy of many large and small businesses to adopt an integrated receivables platform has resulted in “a little automation here and there.” A patchwork of disconnected legacy dashboards produces a higher chance of human error and more time spent on manual tasks for A/R teams. Many organizations learned that one-off payment channel tools on separate platforms can only go so far.

The most successful automation strategies unify all payment channels—online, mobile, lockbox, called-in, mailed-in (check scanning)—into a single A/R automation platform. When all payment methods flow through one connected system, receivables are streamlined, cash flow is accelerated, and visibility improves across every step of the process.

In 2025, many organizations took a closer look at how traditional payment methods (especially paper checks traveling through the mail) were slowing down collections. Between mailing delays, manual handling, and reconciliation time, checks often extend payment cycles well beyond their due dates.

Modern payment channels remove much of that friction. Online payment portals, AutoPay, and electronic bill/invoice presentment and payment allow customers to submit payments immediately, rather than relying on checks that can take days, or even weeks, to arrive and be processed. By moving away from paper-based payments, businesses can significantly reduce days sales outstanding (DSO) and the collections process.

In some industries where checks continue to persist (e.g. distribution, insurance, banking, etc.), mobile check capture technology has proven to significantly accelerate the acceptance and posting of checks accepted in the field. For more details on how a leading distributor has successfully deployed mobile check capture, check out this success story.

3. Visibility drives control of cash flow and customer accounts.

Finance teams realized that speed alone wasn’t enough. Clarity is just as crucial. Having to jump between systems or spreadsheets to understand who’s paid, what’s pending, and how much cash is flowing in often leaves organizations reacting instead of planning.

When visibility into cash flow and customer accounts lives in one central platform, decision-making becomes faster. Easy accessibility to real-time data and customer accounts allows finance teams to look-up customer accounts faster and forecast with greater accuracy.

The 2026 Outlook: Adoption and Expansion

In 2025 many organizations began their automation journey. 2026 will be the year they learn to maximize it. A/R teams are now focused on fully leveraging the unified A/R automation platforms they have in place and expanding their solutions suite. Not to fret, if your organization still has not adopted an A/R automation platform, it is not too late. There's no time like the present to make 2026 a success.

Many A/R teams have only scratched the surface of their automation platforms. In 2026, the focus will shift to full utilization of the A/R automation platform available to them—connect additional payment channels and methods and use the full range of A/R automation solutions already built into these systems.

The best A/R strategies will continue to prioritize efficiency for both the customer and the back-office. Self-service payment options and faster reconciliation unified in a single platform will continue to define efficiency (and success) in 2026.

The Bottom Line

2025 proved that automation is no longer optional, but that it’s foundational. In 2026, the conversation will shift again. The question won’t be whether to automate A/R, but how to utilize A/R automation smarter.

____________________________

1. PYMNTS, "This Week in B2B: A Year's Worth of Payments Innovation" | 2025

2. DocuClipper, "27 Accounts Receivable Statistics for 2025" | 2025

3. PaidNice, "25 Accounts Receivable Statistics shaping AR in 2025" | 2025

4. Gitnux Report, "Accounts Receivable Statistics" | 2025

5. Paystand, 2026 B@B Payment Trends: The Future of Digital Payments Is Already Here" | 2025

The way businesses manage payment acceptance and processing within accounts receivable (A/R)...

Read More

Checks Changing Channels, Online Payments Proliferation, Automated Cash Application & How...

Read More“The customer is always right” — a timeless adage that we’ve all heard before. Even though it most...

Read MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864