Contact Sales (402) 933-4864

Contact Sales (402) 933-4864

Written by: John Karhoff

For many corporations (and banks), integrated receivables isn’t simply a buzz word any longer—it’s become a reality that is transforming AR operations. As companies across multiple industries have looked to third-party technology providers to deliver a solution to simplify and streamline their accounts receivables processes, it has forced many banking institutions to take a closer look at prospective Fintech partnerships and re-evaluate their own treasury management offerings.

If you’ve been a reader of our previous blog posts on the topic, you know FTNI isn’t a believer in “band-aiding” multiple solutions together by providing nothing more than a dashboard that accepts feeds from various, disparate systems. Corporates are looking for ways to save costs, reduce inefficiencies, and gain better visibility and oversight across their entire AR operations. This can’t happen if they are left to manage multiple siloed systems—this just masks the underlying problem of siloed platforms. Instead, offering a single platform that can accept, process, AND post any payment method, from any payment channel can address these pressing issues your clients are dealing with, and it’s time for banks to take the next step in order to become that trusted technology partner your commercial banking customers are looking for.

More Than Just a Way to Get Checks to the Bank

Banks have been offering their commercial customers Remote Deposit Capture solutions for years now—a great way to electronically deposit your checks, all from the comfort of your own office. That’s a huge benefit, but the AR team is still left to sift through their stacks of checks, manually ten-key payment data, manually match it to customer accounts, and manually match to open invoices and statements within their back-office accounting systems—a daunting and error-prone task that can take hours and multiple FTEs depending on the volume of checks and invoices AR team members are having to handle each day.

As I mentioned, banks have been offering their commercial banking customers Remote Deposit Capture solutions for years now—so what is it that’s keeping your customer with your bank’s treasury management offerings? What happens if the competitor across the street offers lower RDC rates? Or what is getting that new commercial banking client in the door? Excellent customer service is fantastic, but what types of value and efficiencies are you able to offer that will prove to be the competitive difference?

More than ever before, it's the ability to be more than just a banking partner; it's being a trusted technology partner as well. One that can deliver proven solutions to help drive efficiencies and cost savings within critical business operations such as accounts receivables. For most customers, getting the payment to the bank is only one small piece of the AR process. Banks' ability to help consolidate, streamline and automate the internal processes of matching and posting AR data into back-office systems will solidify your bank's value as much more than just a depository institution.

Seamless Scalability for All

A true mark of a truly integrated receivables solution is one that can scale with any business—no matter the size, industry, or which payment methods are accepted. It’s no secret that banks work with a wide variety of commercial banking customers—from “mom and pop shops”, all the way up to multi-million and multi-billion dollar corporations.

We’ll be the first ones to admit that smaller businesses dealing with 5-10 transactions a day may not necessarily find huge time and cost savings from having payment data automatically posted to their back-office accounting system. However, there’s no doubt there’s value in a bank providing even its smaller customers with a single platform to scan checks, initiate one-time and/or recurring ACH/Credit Card payments while having consolidated reporting and reconciliation capabilities. No matter the size, no company would prefer to deal with multiple platforms to handle their AR functions if given the option to do it all on a single platform.

Now let’s take your medium to large commercial banking customers that may have complex business rules. No two businesses run the same, so why should they be forced to live with the same receivables technology? Companies’ expectations are changing. They know they don’t have to settle for “out of the box” solutions any longer and that they can search for a platform that is configurable to their specific needs—one that can flexibly scale and evolve with their changing business requirements.

For example, what happens when a commercial banking client books a new block of business and they double or even triple their transaction volumes—sometimes as quick as overnight? “Add more headcount” isn’t necessarily every CFO’s first desire. Having the technology in place that can automate the majority of AR matching and can elevate the exception handling from a single platform provides true efficiencies and cost savings to a business while allowing them to keep the same processes in place, even when their business is booming. Not many companies are going to even consider switching banking relationships if they’re receiving this type of value from a bank-delivered solution.

It’s common for banks to feel like they’re married to their existing vendors—which sometimes leads to the thought that they need to “band-aid” these existing and outdated offerings by offering nothing more than a shiny dashboard that takes feeds. You’re just adding more silos to your customer’s business which adds costs and zero flexibility. Not to mention the frustration when it dawns on your customers that they still have to manage and maintain the legacy systems that feed that shiny new dashboard. It doesn’t have to be this way.

With that being said, it would be unrealistic to think that in order for a bank to move forward with a new solution that they would need to immediately "rip and replace" their existing offerings and convert every customer to a new platform within days. Luckily, they can do this in tandem. The modularity of a truly integrated receivables platform gives banks the ability to configure their offerings on a client-by-client basis—all from a single platform. With minimal investment and manpower, banks can be equipped with a platform that can provide immediate value to a customer’s business based on their unique AR needs of today, while already having the platform that can support their AR needs of tomorrow. In turn, this creates extreme stickiness with a customer. A bank that is seen as not just another bank, but also as a trusted technology partner that can provide added value to business operations is already way ahead of the game.

A true integrated receivables solution should allow your corporate banking customers to incorporate their own workflow processes and rules to streamline and automate as much of their receivables operations as possible—including the ability to automatically match payments to customer accounts and outstanding invoices. Being able to build in unique business rules provides businesses an opportunity to evolve existing processes as their business operations change.

Technological innovation is not something that corporate banking customers have historically expected to receive from their financial institution. But this expectation is changing—and changing rapidly.

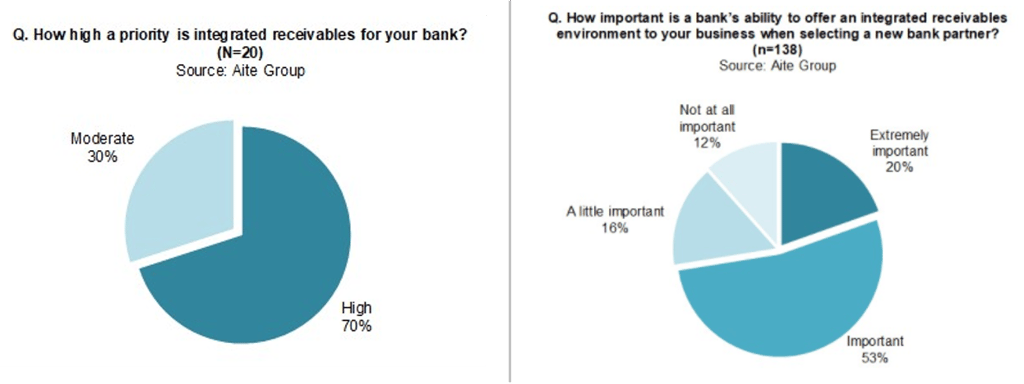

According to recent findings from two new surveys from Aite Group, 70% of banks surveyed rank integrated receivables technology as a 'high' priority. At the same time, 73% of surveyed corporate treasury professionals say a bank's ability to provide an integrated receivables offering is 'important' or 'extremely important', when selecting a new banking partner.

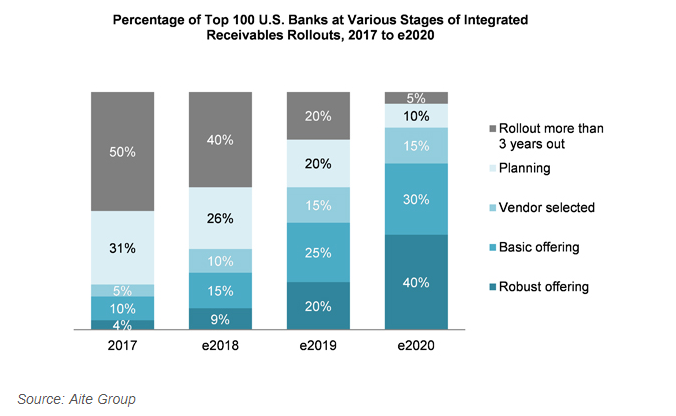

Clearly, all parties involved agree that integrated receivables solutions can, and will, add value to banks and their corporate banking customers. But the fact remains that while banks may rank integrated receivables as a high priority, the vast majority of banks (two thirds according to Aite Group research) are still only 'thinking' about how to add these solutions to their existing product offerings. In fact, based on projections for 2018, 26% of banks surveyed responded that they are in the 'planning' stage, while another 40% said they are still more than three years away from rolling out the technology.

With corporate customers identifying integrated receivables to be something they rank as important, can your bank afford to wait 'years' to bring a solution to market when your customers want/need it now?

Forward thinking banks have recognized the need for truly integrated receivables solutions and are no longer planning, but launching these solutions to take advantage of leadership positions within their respective markets. Afterall, integrated receivables solutions aren't just for 'big' banks, regional and community banks may have even more insentive to add these value-added solutions to their product portfolios as they look to attract larger and more demanding corporate banking customers. The addition of integrated receivables solutions deployed from a single platform provides a differentiated product that their customers likely can't get from their current banking provider. At the end of the day, there is no shortage of depository institutions out there to choose from, but there are far fewer financial institutions that can also function as a trusted technology partner.

We've said it before, but we'll say it again: "talking the talk" is much different than actually "walking the walk" when it comes to integrated receivables solutions. With each passing week, new players in the marketplace are claiming to be able to deliver integrated receivables solutions, but we encourage you to take a closer look behind the curtain, what you find will probably surprise you.

Dating all the way back to 2010, FTNI has been at the forefront of defining what it means to deliver a truly integrated receivables platform. New players have added their own spin, but not all solutions are truly integrated, and even fewer are delivered from a single, cloud-based platform.

Anything less than the ability to accept, process AND post any payment method, from any payment channel—all from a single, secure (and compliant), cloud-based platform, doesn't qualify as a truly integrated receivables solution. At least in our book.

As you evaluate prospective solutions, there are several foundational hallmarks that will help identify and separate truly integrated platforms from legacy, siloed solutions hiding behind shiny dashboards.

With minimal up-front investment and IT involvement, banking institutions are now able to deliver their corporate banking customers with a truly integrated receivables platform that consolidates the payment acceptance, processing and posting of all payment methods and channels. At the same time, just because your bank decides to move forward with an integrated receivables solution, does not mean you need to tear down all existing offerings all at once, that simply wouldn't be realistic.

A true integrated receivables platform is modular and enables you to quickly configure tailored solutions on a customer-by-customer basis. Providing a natural on-ramping and transition period where customers can easily make the move from legacy systems to a single, cloud-based platform. Over time, corporate customers can be switched over and add modules as their business needs grow and evolve.

No longer will your customers have to endure the pain, inefficiencies and rising costs of having to manage and maintain outdated receivables systems. No longer will your bank be seen as simply a financial or depository institution. You will have made the jump to a trusted partner capable of providing time-tested financial support and services, as well as proven technology solutions. You will be the new definition of a 'FinTech'. Isn't that what all banks should be striving for these days?

Originally published March 2, 2018

Originally published on PYMNTS.com on 4/1/2016. In managing accounts receivables, corporate banking...

Read More

If there is one thing we have learned over the history of our business, it is that no two...

Read More

Each day brings new announcements and news from the ever-changing world of payment technology. With...

Read MoreFinancial Transmission Network, Inc.

13220 Birch Drive, Suite 120

Omaha, NE 68164

Sales: +1 (402) 933-4864